Cloud vs On-Premise Accounting Software: How Do They Compare?

Although historically, accounting software was most often housed on an on-premise server and managed locally, the emergence and evolution of cloud computing has meant that cloud accounting software is now more widespread.

But you may be wondering what the difference is between on-premise and cloud accounting software. In this article we explain the key differences and which solution is best for your business.

What are the differences between cloud accounting software and on-premise accounting software?

The answer is simple. On-premise accounting software is hosted by your business, at your premises, on your own servers and hardware, and installed on your computers. In contrast, cloud accounting software is securely hosted by a third-party specialist cloud provider and your staff simply log in to access your software and data.

Cloud accounting software still automates all the usual financial processes including accounts payable and receivable, income, expenses, reporting and more. Ultimately, it covers the same functions and automation as an up-to-date on-premise application, it is simply accessed differently.

There are lots of advantages to consider. Use this article to gain a quick and informative insight into the key differences and benefits of cloud accounting software versus an on-premise accounting solution.

Here’s a quick summary of each.

What is on premise accounting software?

On premise accounting software requires an in-house server, software is installed on individual devices, and often needs to be integrated with other company systems. An IT team has to manage the system including any maintenance, patches, fixes and updates. Access Dimensions is an example of on-premise accounting software.

What is cloud accounting software?

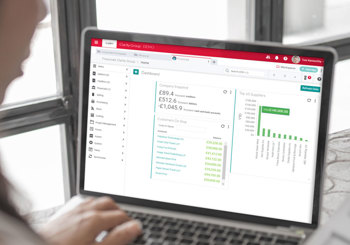

Cloud accounting software (like Access Financials) is hosted off site, removing the requirement for your own company server and infrastructure. The cloud provider’s highly secure infrastructure and datacentre hosts your accounting software and your users simply log in to access the tools and data they need.

The key differences between cloud and on-premise accounting software

What are the advantages of cloud based accounting vs on-premise accounting software?

1. Greater business protection

Moving to cloud based accounting gives your business the added peace of mind from multiple security layers with around the clock monitoring. Enjoy optimum protection against cyberattack or system failure.

2. Enhanced data security

All data is backed up and replicated at a second secure datacentre, which means you can be back up and running quickly if you had to activate your business continuity plan.

3. Supports hybrid working

A cloud accounting solution provides robust connectivity and full functionality, enabling your staff to work effectively from home or any other location.

4. Increased productivity

Is often an unexpected benefit when you provide your Finance team with the latest tools and functionality to make their jobs easier. This is especially true if your on-premise legacy system has become unwieldy or outdated.

5. Regular updates

New features and functionality are automatically updated on cloud accounting software, so your business will always operating on the most up-to-date version with continual support. Compare this to the time taken to update on-premise accounting systems with patches, manual updates and resolving integration issues.

6. Strong cost/benefit case

On-premise accounting software requires capital expenditure for hardware upgrades. In contrast, cloud accounting software is cost-effective to implement, subscriptions are easy to budget for, and your IT resource is released from time-consuming software fixes.

7. Flexible and scalable

On-premise accounting systems can be complex and expensive to scale. Cloud accounting software is a great choice for growing businesses because it’s quick and easy to add users (or to reduce numbers) enabling you to flex capabilities as your business needs change.

Cloud vs on-premise accounting software: Which is best for your organisation?

Of course, only you can decide. It is worth mentioning that one of the key concerns often cited as a reason not to make the change to cloud accounting software is security – however this is actually a compelling reason ‘for’ not ‘against’. Here’s why…

Staying safe and secure requires significant and ongoing investment. The security steps taken by a cloud accounting software provider supporting multiple businesses will be far more sophisticated and complex than anything that is affordable or achievable for most individual companies. Cloud service providers implement the highest security standards and industry certifications – not least because their business depends on it. Cloud infrastructure is designed for resilience with multi-layer security and around the clock protection against physical and cyber threats. The policies, procedures and security in place to protect and secure your information in the cloud means that data is likely to be far more secure in a cloud data centre environment than in any dedicated on-site server room.

Finally, do bear in mind that the majority of businesses have either already moved to the cloud, or are planning to do so. As we’ve seen in this article, there are plenty of reasons why, but for most it’s likely simply to be because it enables them to do so much more.

Are you ready to switch your accounting software?

For expert guidance on moving to cloud accounting software, contact us. Our cloud accounting software experts can provide the support your business needs to make the switch.

Alternatively, why not read more about switching your finance and accounting software.

If you've not yet chosen a cloud accounting system to switch to, you can explore our solution and book a demo with us to see it in action before you buy.

Want to know more?

Have a read through more accounting software information, guidance and advice.

What is a financial management system?

Go to article

How does accounting software work?

Go to article

How to choose the right accounting software

Go to article

How much does accounting software cost?

Go to article

How to implement a new accounting system

Go to article

The Ultimate Guide To Finance Data For Medium Businesses

Go to guideExplore our cloud-based accounting software

Frequently Asked Questions

Is it difficult to migrate from on-premise to cloud accounting software?

Not at all. With expert guidance from providers like The Access Group, switching is straightforward. Their onboarding support, data migration tools, and professional services ensure a smooth transition with minimal disruption.

What should I consider when evaluating cloud vs on-premise for my finance function?

Consider factors such as:

- Security: Cloud providers offer multi-layered protection and 24/7 monitoring.

- Cost: Cloud solutions reduce capital expenditure and offer predictable subscription pricing.

- Scalability: Easily add or remove users and modules as your business evolves.

- Accessibility: Cloud platforms enable secure access from anywhere.

- IT Resources: Cloud reduces reliance on internal IT for updates and maintenance.

- Strategic Fit: Supports digital transformation and hybrid working models.

What are the main productivity gains from switching to cloud accounting?

Cloud accounting streamlines workflows, automates routine tasks, and reduces IT overhead. Finance teams benefit from faster reporting, improved decision-making, and access to the latest tools and features without manual updates.

Is cloud accounting software suitable for hybrid or remote finance teams?

Absolutely. Cloud solutions like Access Financials are designed for secure, browser-based access, enabling finance teams to work effectively from any location.

Can cloud accounting software scale with my business growth?

Absolutely. Cloud systems are designed to be flexible and scalable, allowing you to easily add or remove users and modules as your business evolves.

How frequently are cloud accounting systems updated?

Cloud software is updated regularly with new features and security enhancements, ensuring your business always operates on the latest version without manual intervention.

How does cloud accounting software support business continuity and disaster recovery?

Cloud solutions offer automatic data backups and replication across secure data centres, enabling rapid recovery and minimal downtime in the event of system failure or cyberattack.

Is cloud-based software better than on-premise?

Cloud-based software is generally considered better for businesses that need flexibility, remote access, and scalability. It allows users to access financial data anytime, anywhere, and on any device, which is ideal for hybrid or remote teams. On-premise systems can still be suitable for organisations with strict data control requirements, but they lack the agility and real-time updates offered by cloud solutions.

What are the disadvantages of cloud accounting?

While cloud accounting has some perceived drawbacks, by working with Access you can mitigate these:

- Internet dependency: Access Cloud delivers 99.9% uptime, optimized performance on any connection, and mobile apps ensuring reliable access from anywhere you need.

- Ongoing subscription costs: Predictable monthly costs include automatic updates, security patches, dedicated support, and complete infrastructure, eliminating large upfront capital expenditure on servers.

- Data security concerns: Access Cloud provides bank-level encryption, ISO 27001 compliance, multi-factor authentication, and UK-based data centres that exceed most in-house security capabilities.

- Limited customisation: Access Cloud offers scalable plans with comprehensive features for businesses, allowing seamless upgrades to advanced functionality as your needs evolve.

AU & NZ

AU & NZ

SG

SG

MY

MY

US

US

IE

IE