The Retention Problem in UK Construction: How to Set the Standard as a Main Contractor

Retentions have been a fundamental, if often contentious, aspect of UK construction contracts for over a century. Recent years, particularly since the collapse of Carillion in 2018, have brought a critical shift in perspective. The industry is increasingly questioning the fairness and efficacy of the current retention system, recognising its significant burden on the supply chain.

This article delves into why retentions are such a core issue in UK construction, explores the viable alternatives emerging, and provides practical guidance on how main contractors can proactively manage retentions, setting a new standard for fairness and efficiency.

Contents

What is Retention in Construction?

Retention in construction is a percentage of an interim payment, typically 2.5% to 5%, that a client or main contractor withholds from a contractor or subcontractor.

This withheld sum acts as a security or assurance that the project works will be completed to a satisfactory standard and that any defects arising during a specified defects liability period will be rectified.

The first half of the retention is usually released upon practical completion of the project, with the second half paid after the defects liability period expires.

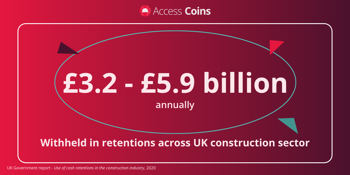

It's estimated that between £3.2 and £5.9 billion is withheld in retentions across the UK construction sector annually. This practice often cascades down the supply chain, from the main contractor to subcontractors and suppliers, multiplying the financial impact.

Why Retentions are Causing Issues in UK Construction

While designed to protect clients and main contractors, the practical application of retentions often creates significant problems for the wider supply chain, particularly for smaller businesses.

Issues caused by retentions in UK construction include:

- Cash flow strains

- Delayed payments (or non-payments)

- Lack of protection in insolvency rules

- Increased project costs

- Commercial relationship damage

- Misuse of funds

Cash Flow Strains

For contractors, especially those working on long-term projects with tight margins, the withholding of a percentage of payment for work already completed can severely restrict cash flow. This 'legal withholding' of earned money can hamper a company's ability to fund ongoing operations, invest in growth, or even meet payroll.

Delayed Payments and Non-Payments

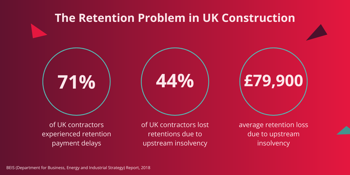

A 2018 BEIS (Department for Business, Energy and Industrial Strategy) report found that 71% of contractors experienced delays in receiving retentions, with an average delay being significantly longer for Tier 2 and 3 contractors. More alarmingly, 44% of contractors lost retentions entirely due to upstream insolvency, with an average loss of £79,900 per contractor. The notorious collapse of Carillion, which held an estimated £800 million in retentions, devastating its supply chain, is a stark reminder of this risk.

Lack of Protection in Insolvency Rules

Critically, current insolvency rules do not ring-fence retention monies. When a company holding retention becomes insolvent, these funds are often absorbed into the general creditor's pot, leaving contractors as unsecured creditors with little to no chance of recovery.

Increased Project Costs

Many contractors, anticipating delays or non-payment of retentions, factor this risk into their tender prices. The BEIS Report indicated that 40% of surveyed contractors increased tender prices to offset retention risks, effectively passing the cost back to the client and inflating overall project costs.

Commercial Relationship Damage

Delays, disputes, and non-payment of retentions can strain commercial relationships throughout the supply chain, leading to distrust and reduced collaboration.

Misuse of Funds

There are strong indications that retentions are sometimes used by firms holding them as working capital or to protect project margins, essentially turning them into an interest-free loan at the expense of their supply chain.

Manage Retentions with Access Coins ERP

With Access Coins ERP, main contractors can manage their retention practices and payments while keeping a close eye on cash flow.

Attempts to Reform Retentions in UK Construction

The pervasive issues with retentions have prompted widespread calls for reform and legislative attempts to address the imbalance.

Past Legislative Attempts

Following the Carillion collapse, several Private Members' Bills, such as the Construction (Retention Deposit Schemes) Bill 2017-2019 (the "Aldous Bill"), sought to introduce mandatory retention deposit schemes. These proposals aimed to ring-fence retention monies in government-approved schemes, protecting them from insolvency and ensuring timely release. While these bills garnered significant industry support, they ultimately failed to progress through Parliament.

International Precedents

The concept of protecting retention funds is not novel. Countries like Canada (requiring retention to be held in separate accounts), New South Wales, Australia (mandatory deposits for projects over $20m), and New Zealand (requiring retention money to be held in trust or secured by a financial instrument) have already implemented measures to safeguard these funds against insolvency.

The 2025 Retention Reporting Law Changes

While mandatory ring-fencing legislation hasn't yet materialised, the UK government is introducing significant changes that will increase transparency and accountability around retentions.

From 1st March 2025, the Reporting on Payment Practices and Performance Regulations 2017 will be amended. These new regulations will require "qualifying companies" and LLPs (generally those with a turnover exceeding £36 million or more than 250 employees) to report on their retention practices within "qualifying construction contracts."

This move by the government, supported by industry bodies like Build UK (who advocate for zero retentions by 2025), is a significant step towards greater transparency and, it is hoped, more responsible retention practices.

Alternatives to Retention in Construction

The challenges posed by traditional retentions have led the industry to explore and advocate for alternative mechanisms that offer similar security without the associated risks to cash flow and solvency.

Alternatives to retentions in construction include:

- Project Bank Accounts (PBAs)

- Retention Trust Accounts

- Performance Bonds

- Retention Bonds

- Parent Company Guarantees (PCGs)

Project Bank Accounts (PBAs)

PBAs involve monies being held in a separate bank account, typically under a trust deed, for identified beneficiaries (the supply chain). Used primarily in public sector contracts since 2007, PBAs offer a degree of security by protecting funds from insolvency. While they can be administratively intensive, efforts are being made to streamline their use further down the supply chain.

Retention Trust Accounts

Similar to PBAs, this involves placing retention money into a separate, ring-fenced fund held in trust. The idea is that these funds would be protected from the insolvency of any party in the contractual chain. Despite being deemed a viable alternative in the BEIS Report, they are currently rare in practice in the UK.

Performance Bonds

A third-party guarantor (like an insurance company or bank) issues a bond to the client, assuring that the contractor will fulfil their contractual obligations. If the contractor defaults, the client can claim on the bond. While widely used, performance bonds often come with an upfront cost that contractors may pass on. They are also typically used in addition to, rather than as a replacement for, retentions.

Retention Bonds

Specifically linked to retention monies, these bonds effectively release the cash retention back to the contractor while providing security for defects. They offer improved cash flow for the contractor but involve an upfront cost.

Parent Company Guarantees (PCGs)

Where a contractor is part of a larger group, a PCG can be issued by a financially strong parent company, guaranteeing the performance of its subsidiary's contractual obligations. This is a viable option when a suitable parent company exists, but due diligence on the parent company's financial standing and domicile is crucial.

How Main Contractors Can Effectively Manage Retentions

As a main contractor in the UK, you have a unique opportunity to lead the way in adopting more ethical and efficient retention practices. Beyond merely complying with the upcoming reporting regulations, embracing proactive management strategies can significantly enhance your reputation, strengthen your supply chain relationships, and ultimately improve project delivery.

Here's how you can achieve this:

Re-evaluate Retention Policies

- Challenge whether a 5% or 10% retention is genuinely necessary for every project or every subcontractor. For smaller, lower-risk packages of work, could you reduce or even eliminate retention?

- Explore and actively propose alternatives to cash retention in your contracts, such as retention bonds or Project Bank Accounts, where appropriate. This demonstrates a commitment to fair payment practices.

- Implement a tiered retention strategy based on subcontractor risk profiles, contract value, and historical performance. High-performing, financially stable subcontractors might qualify for lower retention rates or alternative security.

Streamline Retention Release Processes

- Ensure your contracts clearly define the conditions and timescales for retention release. Avoid ambiguous language that can lead to disputes.

- Don't wait for subcontractors to chase. Implement a proactive system to track defects liability periods and trigger retention release promptly upon their expiry and satisfactory defect rectification.

- Assign specific team members or departments responsibility for managing retention release, ensuring it's not an afterthought.

Foster Transparency and Communication

- Maintain open and transparent communication with your supply chain regarding retention policies and release schedules. Address any queries or concerns promptly.

- Regularly update subcontractors on the status of their retention funds, especially as key milestones (like practical completion or end of defects liability) approach.

How a Construction ERP Helps Main Contractors Manage Retentions

This is where a construction ERP system becomes an invaluable asset for main contractors looking to manage retentions effectively and set a new industry standard.

An ERP system designed for construction can help with retention management by:

- Automating tracking

- Managing payment schedules

- Centralising documentation

- Improving reporting and compliance

- Providing financial visibility

Automate Tracking

Automatically track retention amounts withheld for each subcontractor across multiple projects. This eliminates manual errors and provides a real-time, accurate overview of all outstanding retentions.

Manage Payment Schedules

Integrate retention release dates into your overall payment schedules, generating automated reminders and workflows for timely processing.

Centralise Documentation

Store all relevant contract documents, completion certificates, defect lists, and release authorisations in one centralised, easily accessible location. This ensures that the necessary paperwork for retention release is always at hand.

Improve Reporting and Compliance

Generate comprehensive reports on your retention practices and payment performance, making compliance with the upcoming 2025 reporting regulations straightforward. The system can pull the required metrics, such as retained value percentages, with minimal manual effort.

Enhance Financial Visibility

Provide complete visibility into your financial commitments, enabling better cash flow forecasting and risk management related to retentions.

By leveraging a robust construction ERP system, main contractors can move beyond reactive retention management to a proactive, transparent, and compliant approach. This not only mitigates your own risks but also demonstrates a commitment to fair payment practices, building stronger, more collaborative relationships across your supply chain.

Set the Standard for Retention in Construction with Access Coins ERP

While the retention system in construction has historically served as security, its negative impacts on cash flow, solvency, and industry relationships are undeniable.

With Access Coins ERP, main contractors can manage their retention practices and payments while keeping a close eye on cash flow.

- Gain a real-time view of your retentions

- Centralise your retentions documentation

- Ensure compliance with retention reporting requirements

- Manage your payment schedules

AU & NZ

AU & NZ

SG

SG

MY

MY

US

US

IE

IE