Finance Team Structure: Best Practices to Follow

Finance team structure is crucial to the successful performance of the finance department. But how do you build or redesign a good finance structure? What do you need to consider?

Let's find out!

Contents

Why does the finance department structure matter?

When you start your new role as a Chief Financial Officer (CFO), you may inherit an existing finance team or have the challenge of building a new finance team from scratch.

The finance department structure helps drive the growth of a business and is a critical decision to be made. However, there is no single solution to the perfect finance team structure.

The finance team structure will vary by industry, size of the company, locations, centralised or decentralised working models, whether your team will be remote, hybrid, or office based, and if some parts of the function are outsourced or insourced.

Whatever decisions you need to make as a CFO, a well-structured finance team underpins strategic agility and sustainable growth. According to McKinsey & Company, organisations with optimised finance functions are 1.5 times more likely to outperform peers in EBITDA growth.

Finance team structure: CFO considerations

When a CFO approaches the design or redesign of their finance team structure, it can be a daunting task and difficult to know where to begin.

Structuring your finance team will be just one of the things on your plan for your first 90 days in your new role. Our CFO checklist can help you make an impact in your first 90 days and take a strategic approach to become a successful CFO. Download the 90 day CFO checklist.

However, there are several factors to take into consideration when structuring the finance team:

Size of Company

The size of the company will have an impact on the finance team's structure:

- Small organisations will not need a large finance team and may only consist of the CFO and support staff, with outsourced accounting functions.

- Medium-sized companies will have a more extensive finance department with teams split across accounting, account management and treasury.

- Large companies will have specialists for each core function, including treasury, account management, accounting, risk management and tax management. They may also have business finance teams aligned to business units within the company to support the key business stakeholders and act as business partners.

Alignment to processes

Smaller businesses may have only 2-3 people in the finance team, so they will each take on multiple roles and activities.

Medium-sized companies will have dedicated teams for the central finance processes or workflows. For example, specific teams will be responsible for accounts receivable, accounts payable, procurement and budgeting, and management reporting.

In large organisations, the teams will have team managers and group managers for each function, depending on the number of people in each team. A good rule of thumb is to have one manager for every seven team members (plus or minus two).

Centralised or decentralised finance delivery model

Consider whether your finance team will have a centralised or decentralised delivery model.

A centralised finance operation involves top-down decision-making, and the CFO will be involved in every decision, process and task.

A fully decentralised delivery team will have more autonomy and will be able to make decisions on a day-to-day basis. The CFO will be involved in the more critical decisions, and the head of each sub-function within the finance department will make the decisions for their area.

Location of the finance delivery model

The location of the finance model is also a key consideration. Gartner research in 2021 found that, on average, CFOs place 66% of their finance team in the corporate centre and 10% to 15% in distributed locations. Finance activities are more likely to be centralised in large, complex organisations.

Standardised, automated processes enable a centralised delivery model with a corporate finance centre and a focus on providing good governance and oversight.

However, a fully decentralised model is better for a finance team aligned to business units and provides strategic decision support to the business.

There is no definitive model for a finance department, so a CFO can create the structure that best meets the needs of the business and the finance team.

Automation, outsourcing and technology

Before restructuring the team, analyse the current processes and finance team activities. Can any of the tasks that the finance team currently do be automated?

Any repetitive tasks with a low rate of rework that are not critical path activities could be automated. Consider outsourcing low-value or generalist activities that another cost-effective firm can do.

Conduct a review of the current technologies within the finance department and assess upgrading them to support automation of your processes and resolve bottlenecks and duplication of effort.

Find out how our Finance software can automate your finance processes and streamline your finance operations.

Roles and responsibilities

Clearly define the roles and responsibilities of the finance team members must be to ensure each individual has clarity on their part and understands how they fit into the finance team structure, as well as their incentives and performance measures.

In addition, consider documenting the finance team operating model and its roles and responsibilities. This will add clarity for other business departments, and the finance team, on the services the finance team provides and how they provide them.

Our blog on How to Build a Highly Effective Finance Team discusses how to develop the characteristics of a strong finance team.

Maintaining motivation

Another consideration is how you will motivate the finance team during the structuring or restructuring. Your team members may be worried that they will lose their jobs or that their ways of working will change significantly. This can lead to a drop in motivation, and some may consider leaving the company before the structuring is complete.

There are several steps to take to keep the finance team motivated during this change:

- Communication – Develop an internal communications plan to keep your team updated with the restructure, including the impact on them. Involve HR, the change team and the internal communications team to develop and deliver the plan, where necessary.

- Bring in specialists – For a significant restructuring, you may want to bring in finance change management specialists. Reassure your team that the external specialists are there to help execute the restructure rather than cut jobs.

- Positioning – Ensure that the structuring is seen as a positive benefit to the finance team and that roles will be maintained due to their specialist knowledge and experience. Assure the team that they will be supported during the change and that their vital insight is required to help the restructure.

- Be available for your team – Make sure you are available to answer any questions or concerns your team members may have, and involve HR where necessary. Ensure that you maintain openness and direct communication about the plans to alleviate potential worries and keep the team up to date.

- Share the wins – Openly recognise and reward success during the change, especially recognising good work and individual and collective achievements.

How to Build a Strong Finance Team

Instead of just "structuring," think of "curating" your team. A successful finance team needs a blend of technical, leadership, problem-solving, and relationship management skills. If these skills are lacking, invest in training and mentoring, and encourage collaboration with other departments to strengthen business partnerships.

- Enhance non-technical skills: people with diverse skills and backgrounds create a well-rounded team. Focus on non-technical skills like communication, storytelling, coaching, and mentoring to build a collaborative environment.

- Prioritise continued professional development – in the Work Institute’s report, 17% of employees left due to career reasons, including opportunities for growth, promotion or achievement. Ensure that continuous professional development is top of mind when building your high-performing finance team, to keep skills current and develop new skills to attain promotions and career development.

- Encourage cross-functional working to connect to all departments: strengthen relationships with other departments through initiatives like presentations or seconding finance team members to help non-finance teams.

- Create coaches and mentors – build your team’s coaching and mentoring capabilities to not only develop soft skills but also to support new team members and embed a coaching culture into your department. This will improve relationships with the teams and enhance retention rates through continued support.

Streamlining Finance Processes

To boost efficiency, review and improve finance processes:

-

Review all existing processes – catalogue all your existing processes and highlight any areas where process improvements could be made, such as bottlenecks or duplication of tasks.

-

Process mapping – document and map out all the existing finance processes, including their interactions across departments, and then identify where process improvements can be made.

-

Identify process technology – conduct a review of all technology that is required to support and automate your newly mapped finance processes, so that you can maximise process performance and increase the finance team’s capacity.

-

Train your team – once your new technology and improved processes are in place, train your team in the new working practices, fully document the new processes and communicate the benefits to your team and the wider business.

-

Post Implementation Review – after a few weeks, review the new processes and technology. Consult your team for any feedback on the performance or any glitches that need to be resolved. Identify any improvements that can be implemented in the next iteration.

By taking the time to identify and resolve system and process inefficiencies, you can greatly improve the performance of your finance team. You’ll remove bottlenecks and out-of-date practices, and free up your team to provide more value to the wider business.

Choosing the Right Finance Team Structure for Your Organisation

The Plan-Do-Check-Act cycle remains a gold standard for organisational change. Bain & Company recommends iterative implementation to reduce disruption and build long-term capability. Begin by assessing team capabilities, defining structure, and considering outsourcing strategies where appropriate.

When structuring or restructuring your finance team, the key is to remember that there is no single perfect solution and that different sizes of organisations and teams need different approaches.

There are eight core steps to take in your approach to structuring your finance team:

1. Assess the current finance team’s capabilities

Identify the strengths and weaknesses of your finance team. There may be areas that can be outsourced to specialist firms, or maybe some training is required to enhance skills, or there could be services that are highly developed and can become a centre of excellence in their own right.

2. Assess the finance processes

Review all the processes within the current structure and identify those that can be centralised, automated or outsourced.

Some repeatable processes or processes may need improvement or streamlining before they can become centralised or automated. Identify these processes and include them in your implementation plan.

Processes that are resource intensive, repeatable, low value, and low risk could be ideal candidates for outsourcing.

3. Evaluate different finance function models

Consider whether a centralised or decentralised model will work best within your organisation to deliver the finance services required throughout the business.

For example, repeatable processes that are transactional and used throughout the business could be centralised and automated with technology.

Find out how our Finance software can provide your business with one central view of your finance operations and automate your business processes.

A decentralised model could be required to support specific business units, where a closer alignment to the business is required to provide strategic decision-making and finance insight and analysis.

4. Define your outsourcing strategy

Consider whether the business should outsource some financial processes, then develop an outsourcing strategy to support this.

Review all the activities currently being performed by the finance team and identify candidates for potential outsourcing.

This will enable the finance team to focus on higher-value activities that support the business and its corporate strategy.

5. Define your finance team's organisational structure

The specific organisational structure of your finance team will depend on the size of the team, the services that the team provides, the overall finance function model, and the alignment to the business.

You may want to consider structuring your finance team to align with the finance processes, such as budgeting, planning, forecasting, decision support, management reporting, finance systems and IT, and compliance and controls.

Clearly define the scope of each function’s activities to avoid confusion, overlapping areas, and duplication of effort.

6. Roles and responsibilities

Define specific job descriptions, roles and responsibilities for each member of your new finance team structure.

Build the roles and responsibilities in collaboration with the team members and use role definitions, incentives and performance measures to drive the required behaviour of the individuals, rather than a strict reporting structure.

This empowers the team members to own their roles rather than have a new set of roles and responsibilities imposed on them.

Visit our strategic CFO hub for more tips and resources to help you lead a finance team.

7. Create your implementation plan

Define the implementation plan to restructure the finance team, considering all the steps above. Appoint a project manager to drive through the implementation of the structuring of your team against the plan.

Depending on the size of the restructure, this may also require involvement from HR, specific business units, IT, and business change management.

8. Plan, Do, Check, Act

Whatever approach you take, consider using The Deming Cycle or Plan-Do-Check-Act – a four-step iterative model to improve organisational processes, developed by Dr William Edwards Deming in the 1950s and is still used for Continuous Process Improvement today:

- Plan – Investigate the current situation, develop a plan and framework to implement, and specify the desired outcome and result.

- Do – Implement the plan, starting small, so as not to disrupt the organisation if the solution does not work as expected and can be rolled back.

- Check – Monitor the impact of the changes and check that the desired outcomes are being met.

- Act – Make any changes as required until the desired results are achieved.

Repeat this cycle as often as necessary to ensure you achieve the desired outcomes and results.

Once you have your ideal finance team organisational structure in place, you can focus on creating a high-performing team. Our blog on How to Build a Highly Effective Finance Team discusses the challenges facing the finance team and the key people, processes and technology characteristics required to build a highly effective finance team.

Visit our Strategic CFO hub for more resources to help you succeed as a strategic CFO.

Don't let anything hold you back. Use our guide to succeed as a strategic CFO.

Challenges to consider when structuring your finance team

There are many challenges facing today’s CFO and their finance team in a fast-paced, multi-connected, data-driven business world economy.

CFOs must build a framework to drive profit and growth and guard their businesses against risk. The growing volumes of fast-changing data across disparate systems have become increasingly challenging to manage.

Keeping up to speed with technology trends and changes in the finance industry is almost a full-time job. Here are some of the most common challenges CFOs are facing when structuring their finance team:

Lack of proper systems

Without proper systems and processes, the CFO and their finance team are caught up in day-to-day administrative tasks like manual data entry and manipulation or rekeying information. This leads to frustration in the finance team and manual errors. Instead of using the data for management information, your staff spends significant time making sure the data is accurate – by which point the data is probably out-of-date.

Operating in silos

For many organisations, the data remains in silos, either on disparate systems or spreadsheets. When information isn’t stored in either a single, central location or seamlessly connected – as well as being easy to access and understand – it makes it impossible to get a single version of the truth, let alone lead the business forward. Rarely is the bigger picture found in isolation.

Time and resource pressures

Due to time and resource pressures and the difficulty of pulling information together, finance teams and the wider business often analyse historical data, providing static reports which are of little value in supporting business decisions about the future.

Complexity of data

In many cases, the sheer volume and complexity of the data in the business can be a barrier to unlocking its value and turning it into useful management information. Successful CFOs recognise that using technology that automates and streamlines repeatable processes encourages the finance team to focus on what matters.

The amount of data is phenomenal, but what’s worse is the lack of harmonization. Unstructured data is what kills you. The key for me is how do I get back data in a usable and consistent form, such that the business can look at it, understand where the value chain is, and make decisions.

Read more related questions

How should a finance team be structured?

A finance team should be structured to match the organisation’s size, complexity, and strategic goals. Small businesses often rely on generalists and outsourced support, while mid-sized firms build dedicated teams for core functions like budgeting and reporting. Larger enterprises typically adopt specialised roles across FP&A, tax, treasury, and compliance, often aligned to business units. Key factors include delivery model (centralised or decentralised), automation potential, and governance clarity. The right structure should support agility, compliance, and strategic decision-making.

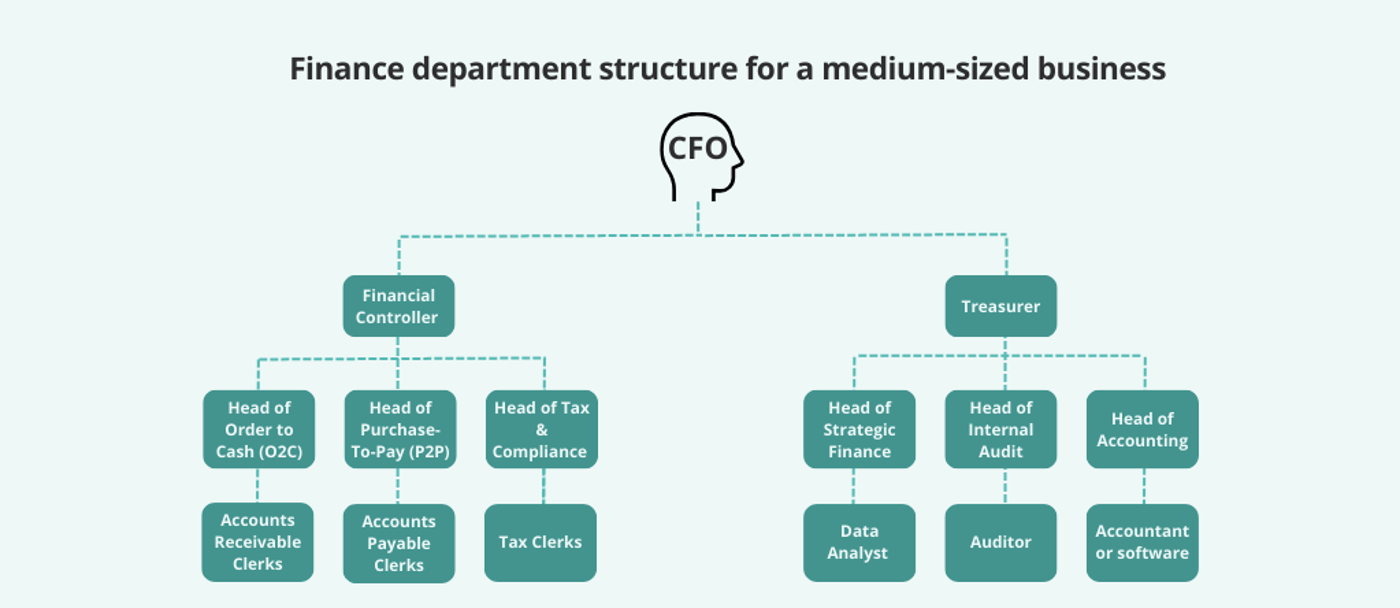

What is the hierarchy in the finance department?

A typical finance team hierarchy includes:

- CFO or Finance Director – Leads strategy, risk management, and financial reporting.

- Senior Managers – Roles like Financial Controller or Head of Finance oversee compliance, planning, and operational control.

- Mid-Level Specialists – Finance Managers, Tax Leads, and Accounting Managers handle day-to-day processes and analysis.

- Operational Staff – Accountants, Analysts, and AP/AR Specialists manage transactions, reconciliations, and reporting.

- Support Roles – Finance Assistants and Clerks provide administrative and data entry support.

How to manage a finance team?

To manage a finance team effectively, set clear goals, delegate ownership, streamline processes, and foster continuous feedback. Strong leadership balances strategic direction with operational clarity.

How to succeed as a Strategic CFO

Adopting a strategic approach may seem daunting, pick up some tips on what strategic should look like and how you can take your business to the next level.

New CFO checklist: 90-day plan

Learn more about your first 3 months as a new CFO and where to start with our 90-day checklist.

7 essential skills for a CFO

Have a read through the 7 essential skills for a CFO to make a positive and lasting impact in your organisation.

How to become a successful CFO

Take a look at the common traits shared by successful CFOs and the key elements and skills that will add to CFO effectiveness.

How a CFO can use Business Intelligence

Read how successful CFOs use Business Intelligence to drive company strategy and support finance operations.

Prepare for the financial year-end. Download the year-end checklist and tick off as you go.

Tips to help you lead a finance team

The Strategic CFO needs to deliver strong financial performance, and for this needs a strong finance team to support and align on those goals.

11 KPIs your finance team should monitor

What are KPIs, and why should your finance team track them? Explore the top 11 KPIs your finance team should track and why.

How To Build a Highly Effective Finance Team

Learn how to build a finance team that will support the business’s financial growth, strategy and performance.

How to become a Finance Director

Read the key skills required of a Finance Director and the steps you should take to get there.

How can technology support you as a Strategic CFO

For any organisation to be successful it’s important to be able to identify when it’s time to change your strategy and drive your business forward.

The key signs it's time to change your business strategy

Explore the 3 signs of a poor strategy and how a modern, data-fuelled approach can make a difference.

Key signs it's time to change your accounting system

This webinar discusses the impact of under investment in software, why companies decide to change accounting systems, and how to choose the right supplier

The data-driven future of finance and why CFO's need to embrace it

Take a look at the role and the importance of data to gain a better understanding of the financial health of the business.

Guide to CFO software

Look at the software tools which are of most use to the modern CFO, as well as the latest technology trends to look out for.

AU & NZ

AU & NZ

SG

SG

MY

MY

US

US

IE

IE