EarlyPay

EarlyPay

Help your workforce through the cost of living crisis with Access EarlyPay, the on demand pay app

Give your staff the financial freedom they deserve

Access EarlyPay is the on demand pay app which gives your employees instant access to pay they’ve already earned. Not only does this help with financial management through these difficult times, but also lead to a more engaged workforce and reduced staff turnover.

Why Access EarlyPay?

Give your employees control over their earned income while fostering engagement, boosting retention, and positioning your company as an employer of choice.

Award winning technology!

Our technology has been honored with the "Best Business Payments System for Employers" award at the FinTech Futures PayTech Awards 2024. This recognition highlights our commitment to delivering innovative payment solutions that enhance efficiency for businesses. By choosing our award-winning platform, you're investing in industry-leading technology recognized for its exceptional performance and ability to meet modern employers' needs.

Explore Access EarlyPay On Demand Pay Solutions

Why should I consider on demand pay?

With the current economic climate, businesses and employees alike are facing financial struggles. As an employer, you may not be able to increase salaries, but you can help to reduce the pressure and boost your employees financial wellbeing by allowing them access to their accrued salaries. All while reaping the business benefits of a more engaged workforce, increased retention, and higher competitivity in the recruitment space.

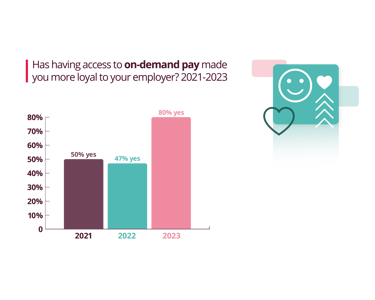

Our latest survey shows companies offering on-demand pay see:

- 46% increase in current staff taking on more shifts

- 80% increased loyalty

- 73% higher chance of recruiting against a company that does not offer on-demand pay

Now introducing Thrive: financial guidance from EarlyPay

You can now provide your employees with the opportunity to enhance their financial knowledge through an expanding collection of guidance and approaches for handling money smartly, all accessible within the EarlyPay app.

From helpful suggestions about consolidating debt to ways to better manage utility costs, you can empower your team with the understanding they need to make thoughtful financial choices. By providing them with valuable examples and guidance, we hope that your employees feel more confident to manage the intricacies of personal finance.

How EarlyPay Transformed Cash Flow for Maria Mallaband

Discover how Maria Mallaband, a leading care provider, streamlined their payroll process and improved cash flow with EarlyPay.

Find out how on demand pay can help you engage employees, boost productivity and improve retention

How does on demand pay work?

With no dreaded long-term software project, EarlyPay integrates with your time and attendance or payroll system:

- Your employee withdraws their earned income via the EarlyPay app.

- The Access Group pays the money directly to the employee's bank account.

- The withdrawal and fee is logged in your payroll system.

- At payroll reconciliation, the withdrawal and fee are shown as deductions.

- On payday, the employee receives their net pay, and will see the withdrawal amount plus the transaction fee on their payslip.

- The withdrawal and transaction fee is collected from you via direct debit after your payroll date.

It’s as simple as that!

The Co-Operative Bank

Ruth Clarke, Head of People Delivery at The Co-operative Bank explains the simplicity of offering on-demand pay with zero impact on payroll processes.

"Honestly there isn’t anything negative to say. There's no drawback to it. It's just positive. We were cautious in the beginning and weren't necessarily sure whether this was the right thing for us, but that’s just dissipated now. All gone! It's completely bought into from board level as something that the bank now offers as a real positive."

EarlyPay on demand payments useful resources

On demand pay: a payroll professional’s perspective

As more and more companies across the UK choose to give their employees flexible pay options via on demand pay, we take a look at what this means for HR and Payroll professionals.

In the first of this two-part series, we talk to Darya Shuturminska, Payroll and Expenses Manager at The Access Group who was responsible for rolling Access EarlyPay out to over 2,000 Access employees.

On demand pay: a HR professional's perspective

With the presence of on demand payments growing rapidly in the UK, we take a look at what this means for HR and Payroll professionals.

In the second part of this series, we talk to Ellen Mabon, HR Assistant at the Access Group who was responsible for rolling Access EarlyPay out to over 2,000 Access employees.

Which on demand pay provider is best for your business: Wagestream vs Access EarlyPay

In recent years, on demand pay has emerged as a popular employee benefit. It allows employees to access their earned wages before their next payday, providing them with financial flexibility and stability. More employers are considering offering on demand payments to support their workforce through the tough financial times so to help you understand more, in this post we will compare the two services from Wagestream and Access EarlyPay, exploring their similarities and differences.

Access EarlyPay in the news: How can businesses support employee wellbeing?

As the cost of living crisis and wider financial headwinds continue to put strain on household budgets, there’s no doubt that these macroeconomic considerations must rank highly in employers’ wellbeing strategies.

Abhishek Agrawal, director of Access EarlyPay, commented on a recent feature for Management Today, discussing the role that early access to wages that have already been earned can have to “empower” employees to take control of their finances.

EarlyPay FAQs

What is on demand pay?

On demand pay allows your workforce the flexibility to access the wages they have already earned as and when they need it without impacting your payroll processes. It is not a loan and with no interest to pay, they will simply be able to draw down from their accrued salary in times of financial need.

Blog Spotlight: Access EarlyPay

Read our latest blogs on all things Access EarlyPay on demand pay covering key industry questions and trends.

Access EarlyPay newsSee what our customers say

"After getting an unexpected payment come out of my account, I was able to use Access EarlyPay to take part of my monthly salary early so I didn't incur charges for going into my overdraft. Ultimately saving me money in the month. This was completed within minutes. It's a relief to know that I have the option there should I need it in emergencies."

EarlyPay user review, Google Play Store