Empowering financial wellness through on-demand pay

As the cost of living continues to rise, many hardworking individuals find themselves struggling to make ends meet. Living pay check to pay check and worrying about how to cover essential expenses can be a stressful and overwhelming experience.

A solution for financial flexibility and peace of mind

With the rise of on-demand pay solutions like Access EarlyPay, individuals have greater control over their financial wellbeing. Here at Access, we believe in empowering individuals with the tools they need to take control of their finances. Our on-demand pay solution, Access EarlyPay, allows individuals to access their earned wages whenever they need them, providing greater financial flexibility and peace of mind.

Through Access EarlyPay, we've seen first-hand the positive impact on-demand pay can have on individuals' financial wellbeing, and the continued business benefits of increased morale, loyalty, and retention.

Real-time insights into on-demand pay trends and behaviours

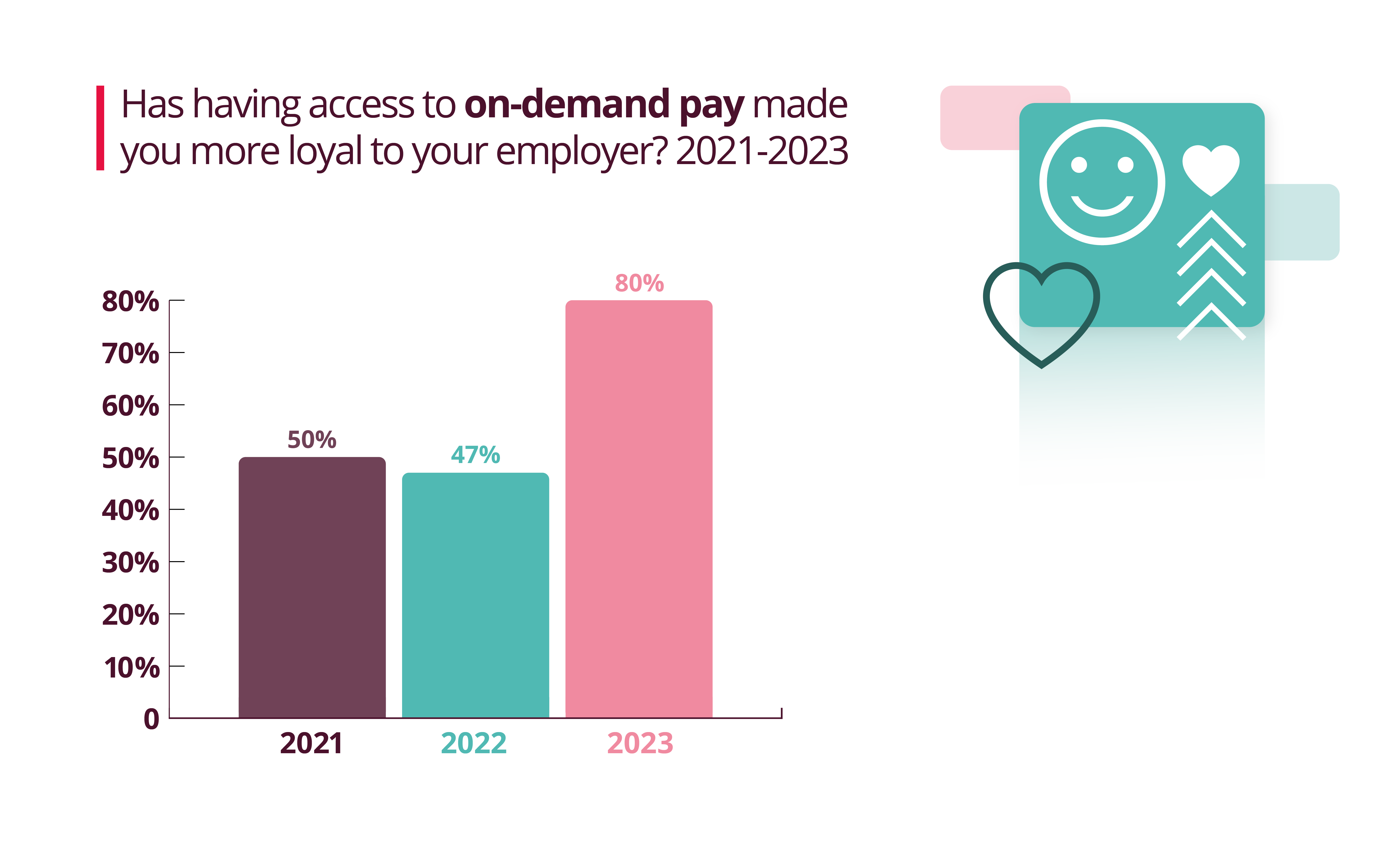

We recently conducted our annual user survey which is now in its third year. The results from this show that in 2023 80% of those who use Access EarlyPay feel increased loyalty to their employer, compared with 47% in 2022. 46% said they take on more shifts because they can access their earned wages immediately.

Furthermore, 93% of Access EarlyPay users credit on-demand pay with helping them through the cost-of-living crisis, showcasing the significant role that access to on-demand pay can play in addressing financial challenges for individuals, especially in times of crisis. 75% of respondents who would have previously relied on high-cost credit facilities report using these facilities less since having access to on-demand pay.

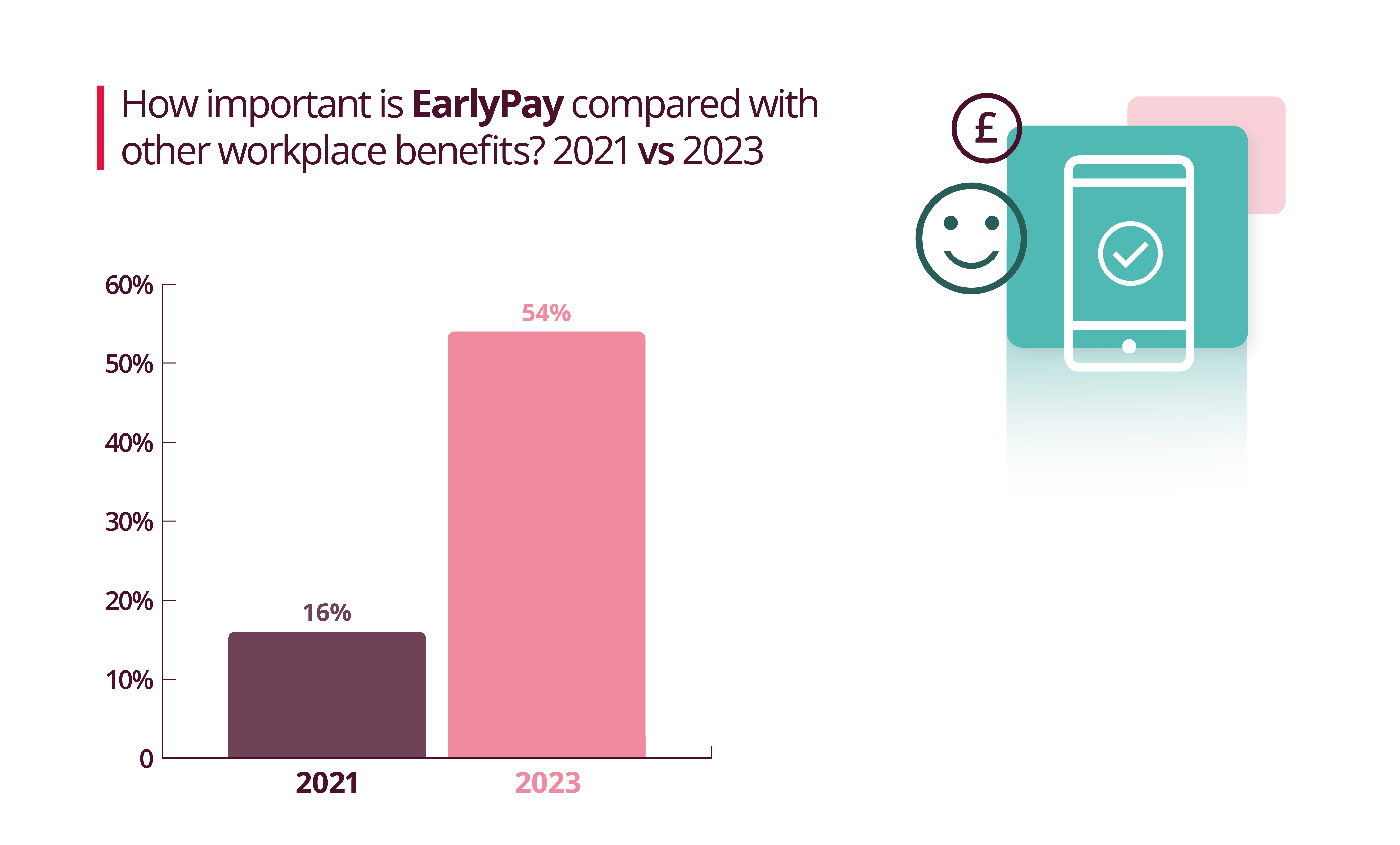

On-demand pay is becoming more important in recent years, and this trend is expected to continue well into the future. In 2021, on-demand pay was considered important by 17% of employees. This has seen a 64% growth in 2023, with 54% now citing it as ‘very important’ reflecting a significant shift in the way that people think about pay and the role that it plays in their lives.

Groceries, home emergencies, and utilities remain the most popular reasons for drawing down wages early. We believe that financial control should be a fundamental right, and 70% of individuals agree.

The impact of cost of living on the usage of on-demand pay

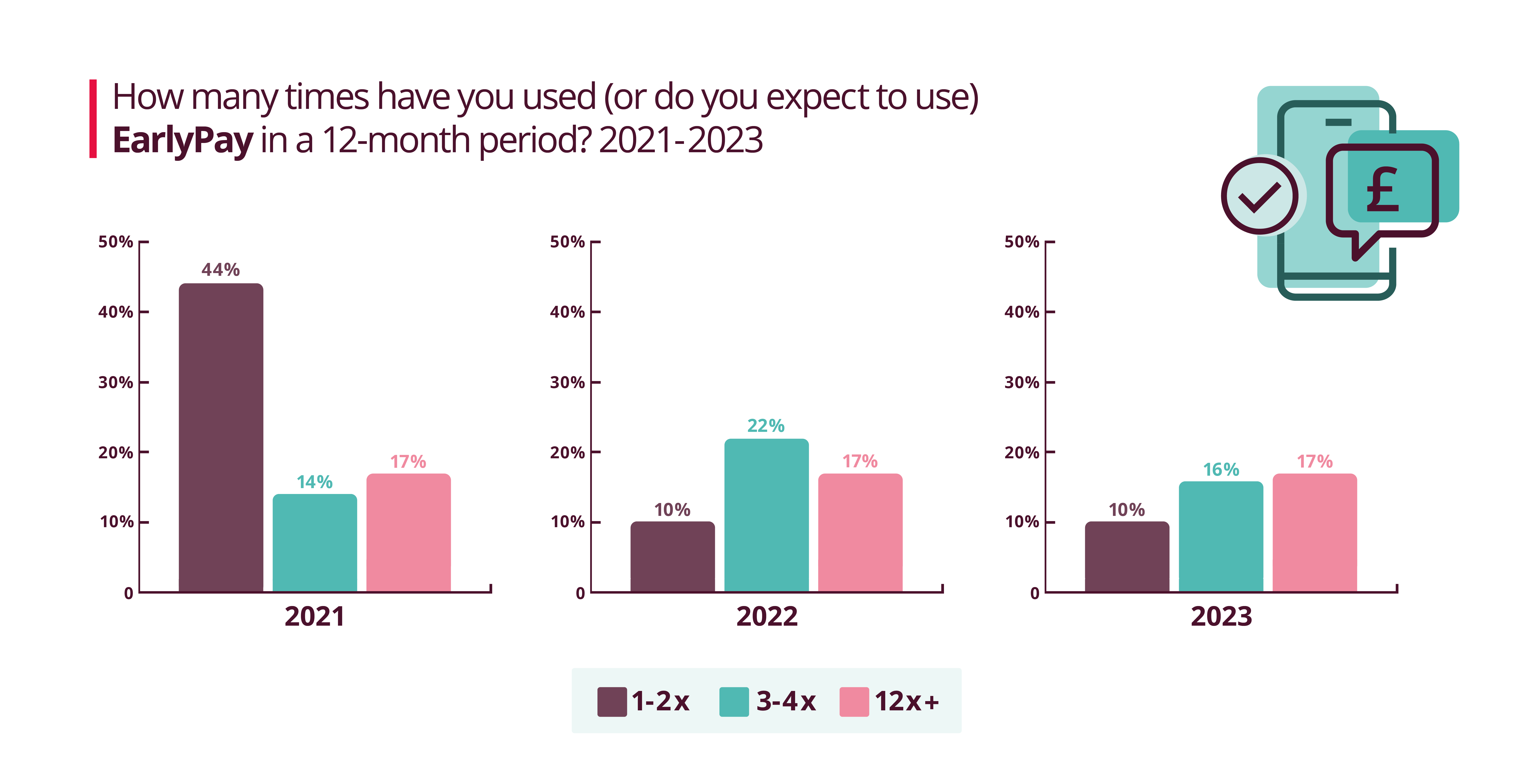

We are also seeing a shift in the way on-demand pay is used. In previous years, the majority of employees have reported accessed their wages only a handful of times throughout the year but as employees are finding it increasingly difficult to make their monthly wage cover crucial costs, we are seeing an increase in those who are using the service more often.

A game-changer for financial wellness and employee satisfaction

At Access, we're committed to making financial wellness accessible to everyone. Our on-demand pay solution puts the power back in the hands of hardworking individuals, allowing them to cover essential expenses, unexpected emergencies and take control of their financial future.

Join us in empowering financial wellness through on-demand pay.

Contact us to learn more about EarlyPay and how it can benefit your employees and your business.

Get in touch

Methodology and references

We conducted a survey in February 2023 via SurveyMonkey and reached out to 10,000 active users of Access EarlyPay.