Big Movers: The UK Locations Paying The Most On Stamp Duty Since Its Return

The promise of saving thousands of pounds on their property purchase sent home buyers clamouring to compete before the government’s Stamp Duty Land Tax (SDLT) came to an end last September.

It wasn’t just buyers who benefited either. The ‘stamp duty holiday’ brought much-needed new business for conveyancing teams after the uncertainty at the start of the pandemic – although pressure to meet the deadline led to widespread reports of solicitors working excessive hours, and burnout.

Now our research has uncovered which of the UK’s largest 100 towns and cities have buyers paid the most during the first six months since the return of pre-pandemic stamp duty rates (1 October 2021 - 31 March 2022).

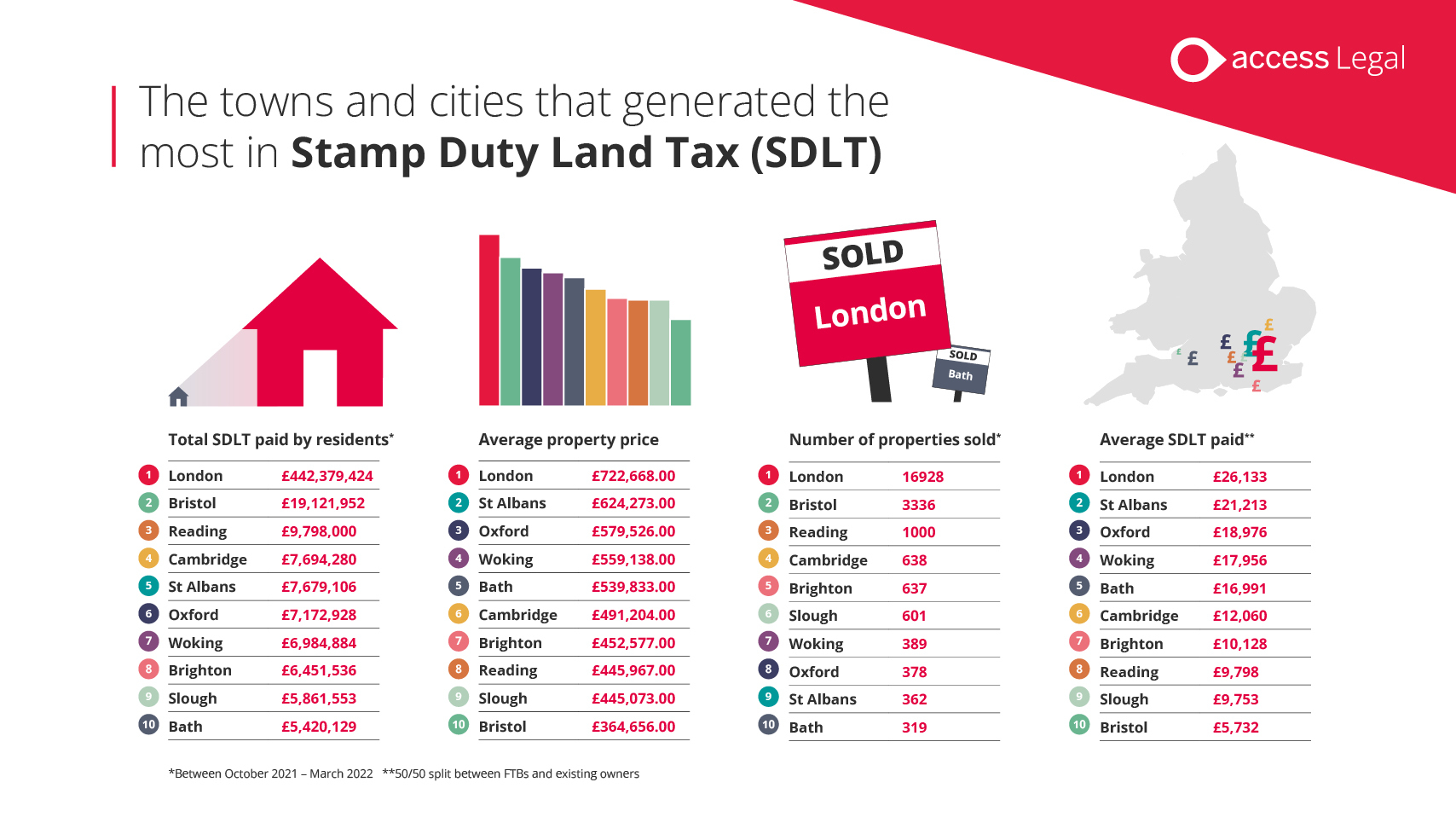

Of the estimated £679 million generated for the treasury by these 100 locations, around £442 million – or nearly two-thirds of the total – came from London property sales. Second on the list, but much further down, was Bristol with £19 million, or around 4%.

The towns and cities that generated the most in SDLT are:

Our research also showed that across the country, people who already owned a property paid an average of £5,241 while first-time buyers paid £2,291.

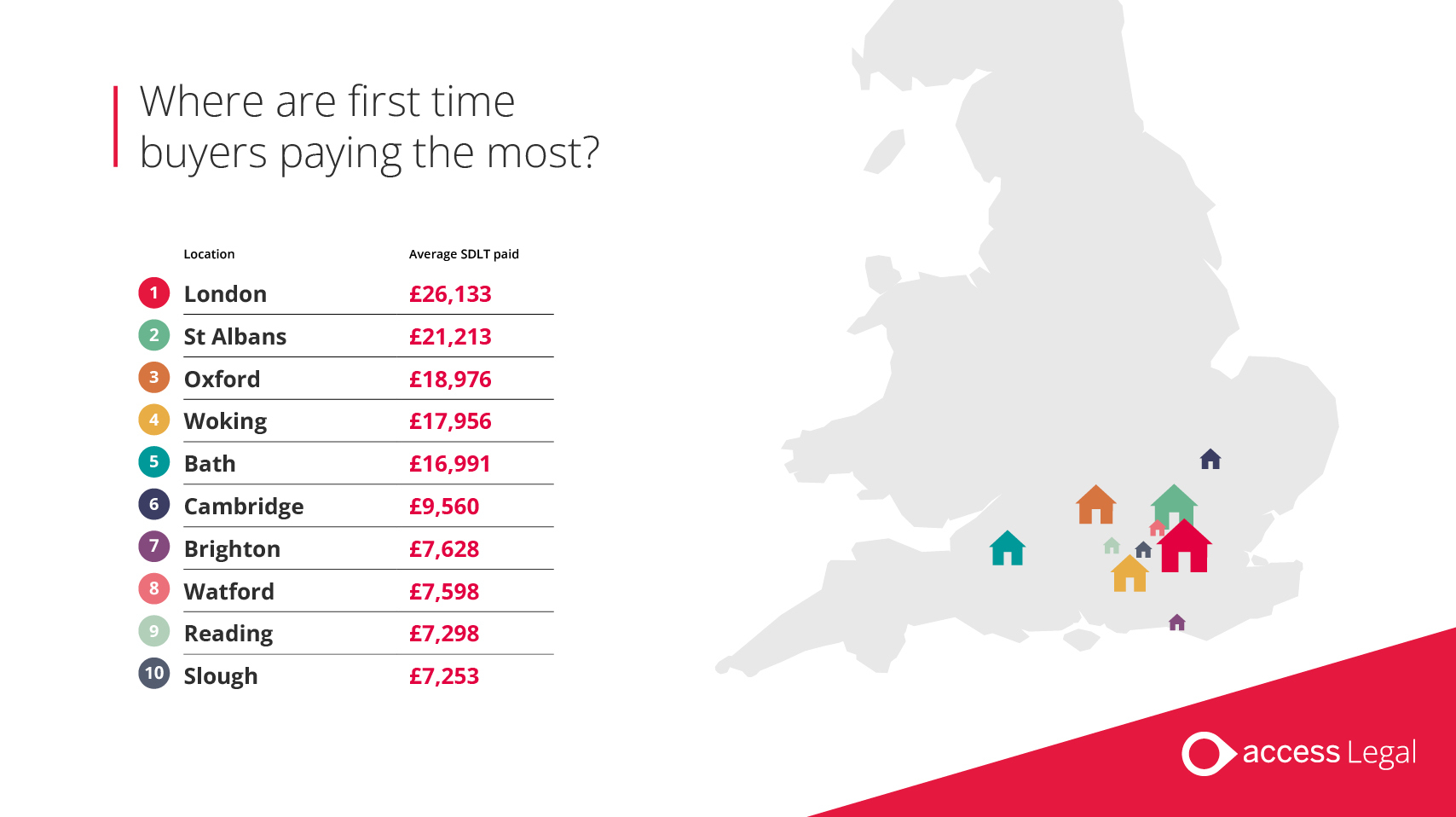

However, buyers in some of the most desirable parts of the UK forked out more than £20,000 in SDLT during the same period.

Huge regional variations in the housing market meant that Londoners stumped up £26,133 on their purchase, followed by St Albans at £21,213 and Oxford (£18,976).

The top 10 towns and cities where SDLT was highest for existing owners are:

Although first-time buyers can be exempt from SDLT, it seems that the high price of property in some regions – as much as £722,668 in London – meant that some weren’t eligible for the relief, which is only available on properties of up to £300,000. In many places, they paid, on average, as much as people who already owned a property.

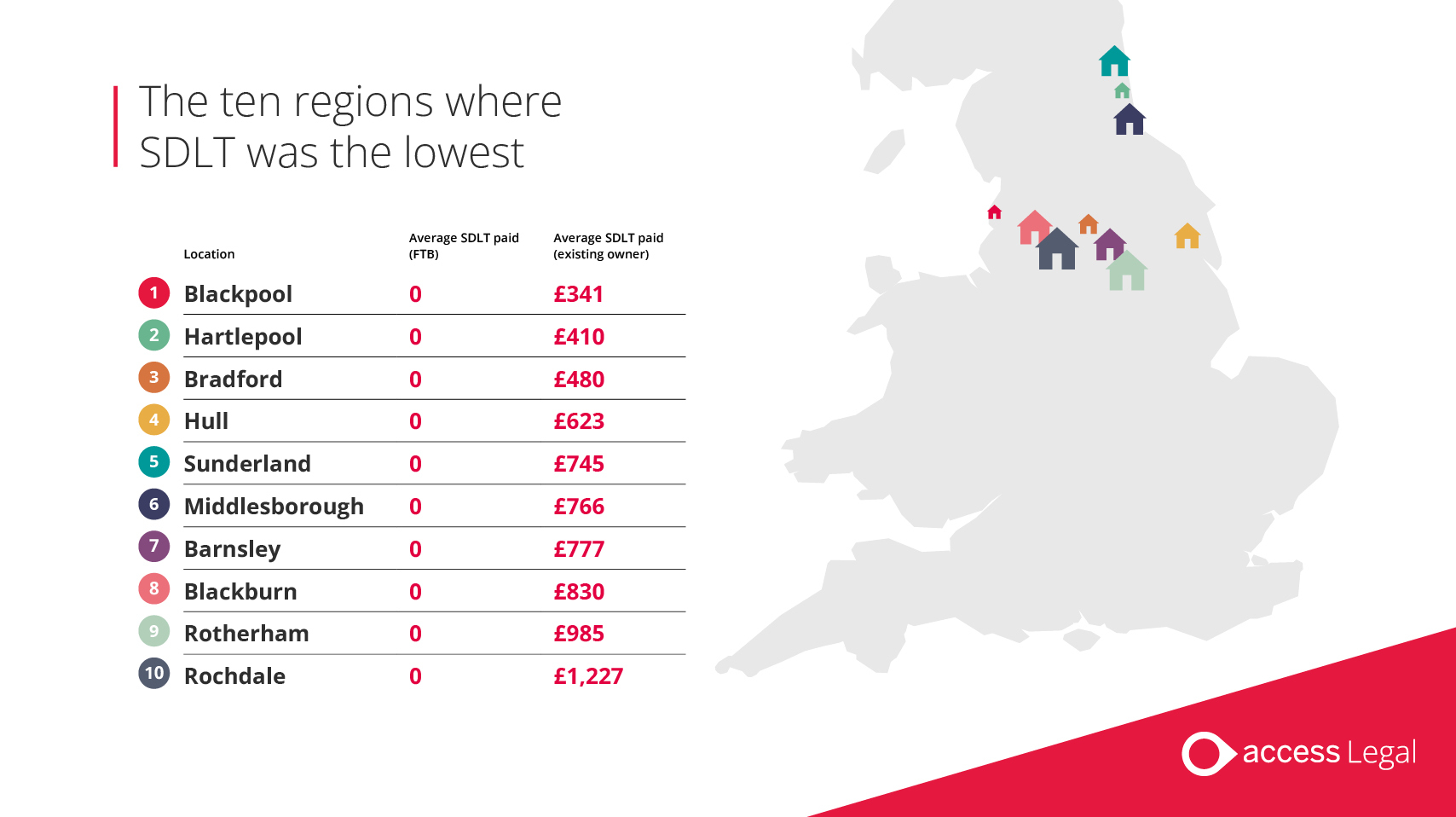

Which locations paid the least in stamp duty?

At the other end of the scale, buyers in Blackpool, Hartlepool and Bradford paid just a few hundred pounds on sales completed after the stamp duty holiday ended, while first-time buyers paid nothing.

The ten regions where SDLT was lowest are:

Commenting on the findings, Mike Connelly, Director of Legal Bricks, an Access Legal company, said:

“We all know that buyers pay a premium to live in the South-East, especially London, but the figures show just how much they’re paying in tax alone compared to people in other parts of the country. First-time buyers, in particular, who also have to pay thousands-of-pounds in SDLT, will see a real dent in their deposits, or have to borrow more on their mortgage to pay it.”

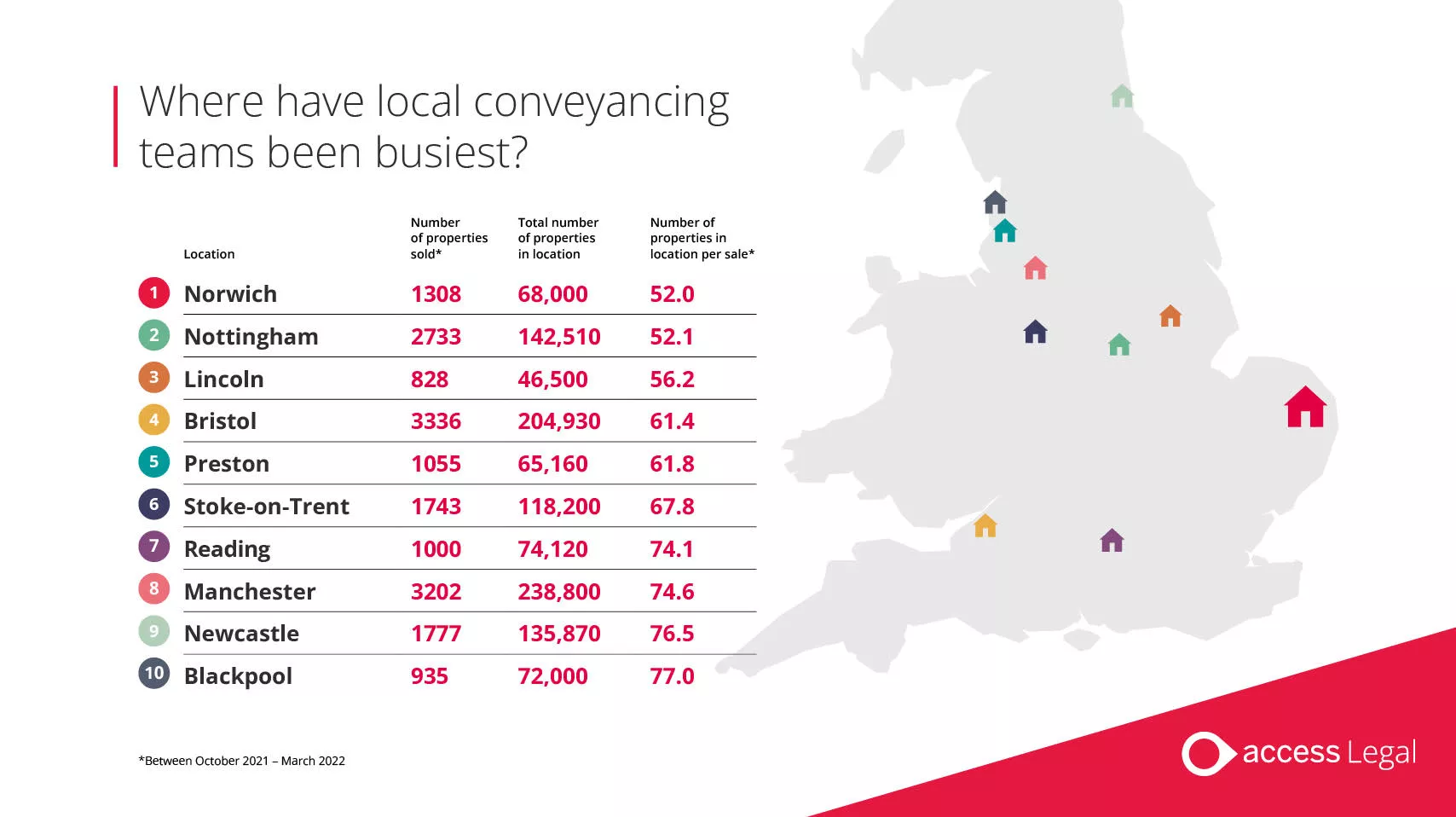

Our research also compared the number of property sales with the total number of properties to uncover where conveyancing teams might have been busiest.

Norwich topped the list with the highest number of sales transactions, with one for every 52 properties available in the city during the six month period. Closest behind were Nottingham (52.1) and Lincoln (56.2).

Mike said: “This suggests that even with the SDLT holiday coming to an end, demand for housing in some parts of the UK remains high.

“Many solicitors are still dealing with high volumes of conveyancing work and without the proper tools in place, they’ll end up working long hours, risking burnout and poor client service.

“Those who’re using good conveyancing software and case management software, on the other hand, are able to work more efficiently and not just improve the profitability of every case but drive up client satisfaction too. Our platform specifically design for conveyancing can reduce conveyancing transaction times by almost a third, which frees up fee-earners to do more with their day and enjoy a better work-life balance.”

Claire Flynn, mortgage expert at online mortgage broker, Mojo Mortgages, adds:

“The stamp duty holiday was good news for many, seeing house sales reach record levels, and helping to alleviate some of the financial pressure of buying a property for first-time buyers and existing homeowners.“

"While first-time buyers still benefit from an exemption on properties up to £300,000, house prices are currently at record highs which means we’ll likely see a considerable increase in the number of new homeowners paying for stamp duty.

“This will be exacerbated by the end of the help-to-buy scheme in March 2023, which could make it even more difficult for those trying to get their foot on the property ladder in areas such as London, Bristol and Reading where the average cost of a home exceeds the £300,000 exemption threshold.”

The SDLT holiday put the levy in the spotlight – but what exactly is it and why do we pay it?

What is stamp duty and where did it originate?

The levy is a percentage of the sale price of land and property, although how much you pay depends on how much it’s worth and whether or not you own a property already.

A first-time buyer is exempt from SDLT on properties under £300,000, and pays 5% on the portion on properties priced between £300,000 and £500,000. Those already on the property ladder are also exempt on properties below £125,000, then 3% on the portion between £125,001 to £250,000, 5% on the portion £250,001 to £925,000, and so on. Full details are available on the government website.

A type of stamp tax was first introduced in 1694 for a range of goods to pay for the war in France but after various incarnations over the centuries, it became the SDLT in 2003, replacing stamp duty.

What does stamp duty actually pay for?

Like other taxes, SDLT goes to the treasury to pay for public services.

Is another SDLT holiday needed due to rising costs of living?

Soaring inflation has left household budgets squeezed, prompting fears of an imminent recession and a sluggish property market. Exempting more buyers once again could increase transactions – but, as happened previously, it may also push up property prices further, so any savings they make might have to go towards bigger deposits.

Methodology and references

To work out the number of properties sold per location and the average property price paid, we analysed house price data from Zoopla.

We compared the number of properties sold in this six month period to the number of properties located in each location based on the most recent (2021) Council Tax stock of properties data: https://www.gov.uk/government/statistics/council-tax-stock-of-properties-2021 (Table CTSOP3.0)

Stamp Duty rates for both first-time buyers and existing owners were calculated using Money Helper’s Stamp Duty calculator, with the average SDLT per location being based on the assumption that half of property purchases were made by first time buyers.