How does the Cycle to Work scheme work for employers?

7 in 10 employers who offer the Cycle to Work scheme say the scheme improved staff health according to Cycle to Work Alliance. So, how does the Cycle to Work scheme work for employers?

The Cycle to Work scheme is a hugely popular employee benefit and for good reason.

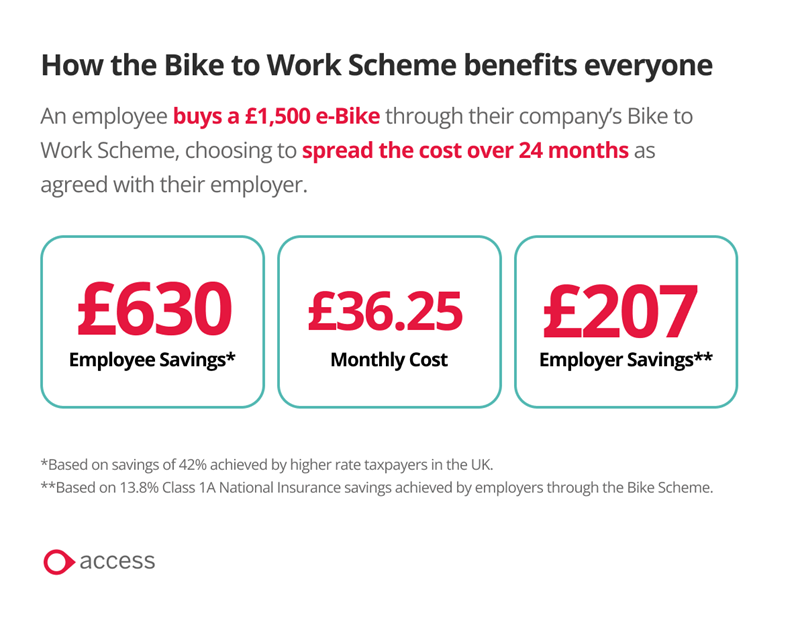

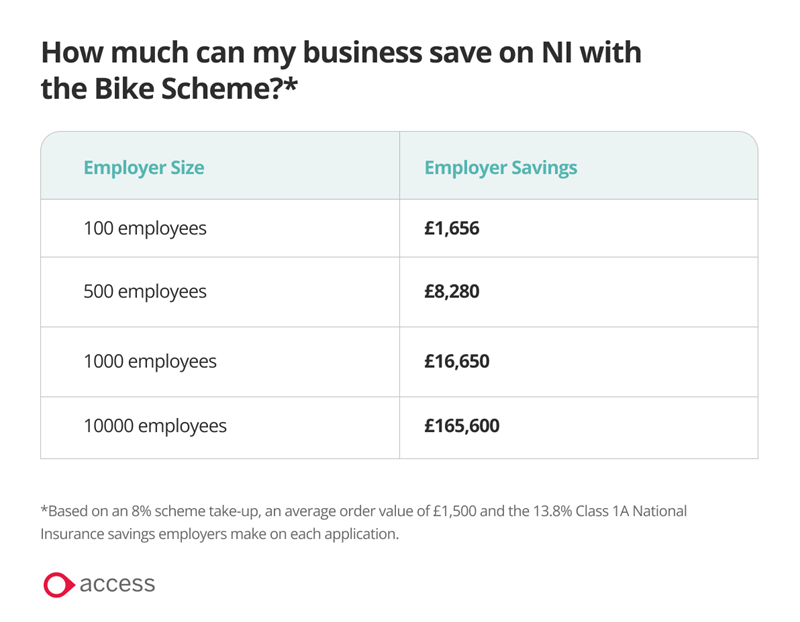

In a nutshell, it helps employees spread the cost and make big savings on cycling compared to what they’d typically find on the high-street, while employers also save in Class 1A National Insurance (NI) while promoting a healthy, active lifestyle for their employees.

In this guide, we’ll go through exactly how the Cycle to Work scheme works for employers, from setting up the scheme to relaunching a new scheme window.

We’ll also touch on a few common questions employers typically have around how to set up the Cycle to Work scheme and managing and promoting it too.

5 minutes

5 minutes

Written by The Access Group

How does the Cycle to Work scheme work?

Here’s what you as an employer could typically expect in setting up and managing a Cycle to Work scheme.

The first thing you need to do is get your Cycle to Work scheme set up if you haven’t already.

This stage is simple, quick and easy with the right Cycle to Work scheme provider.

How to set up the Cycle to Work scheme

The quickest, easiest and most effective way to set up the Cycle to Work scheme is to go through a Cycle to Work scheme provider.

At Access, we provide the Cycle to Work scheme to organisations of all shapes and sizes, helping them get up and running in no time.

Your chosen provider will do all the heavy lifting for you, while you’ll also be able to set scheme limits and choose the duration of the scheme.

Doing this through a provider also eliminates a lot of manual administrative tasks around downloading and uploading employee data and managing applications.

For the full experience, hosting your Cycle to Work scheme on an employee benefits platform can help automate many processes and allows for integration of the scheme with your payroll to ensure compliance and a smooth operation of the scheme.

Go live

Now your Cycle to Work scheme is live, employees will be able to apply for the scheme and you’ll be able to start receiving and managing applications.

If you’re hosting your Cycle to Work scheme on an employee benefits platform, you may require employees to register to use the platform before they can apply.

In this instance, an employee can log in and use a Cycle to Work scheme calculator through their platform to calculate their savings and repayments as they decide which bike they want to buy through the scheme.

Employees will then apply for the amount their chosen bike costs and once their application has been approved, they’ll receive a Letter of Collection (LOC).

With our Cycle to Work scheme, employees then take their LOC to their chosen retailer and use it to pay for their chosen bike and/or accessories, with over 1,500 bike shops to choose from in the UK through the scheme.

What happens at the end of the cycle to work scheme?

At the end of the Cycle to Work scheme and once the repayment period is over, the employee can choose to keep the bike.

As part of the agreement, employees lease the bike from the employer. This means all they have to do at the end of the scheme is then simply pay a nominal fee as part of the agreement to take full ownership of the bike. This fee is calculated dependant on the initial price of the bike.

The employee can then apply for the scheme again in future should you decide to open a Cycle to Work scheme application window again.

Does Cycle to Work cost the employer?

Inevitably, there will be some cost to the employer in sourcing, setting up and managing the Cycle to Work scheme, be it through human resource or financial resource. That said, the Cycle to Work scheme is very low cost and extremely cost-effective. So, is the cycle to work scheme worth it? Here’s an example of how much businesses can save through the scheme:

Can an employer claim back VAT on the Cycle to Work scheme?

Yes, employers are expected to recover VAT on the purchase of a bike and equipment through the Cycle to Work scheme. According to government guidelines, this must be based on the value of the salary deducted as part of the salary sacrifice arrangement between the employer and the employee for the purchase of the bike through the Cycle to Work scheme.

How to get the Cycle to Work scheme

We’ve been setting up and running Cycle to Work schemes with our clients for over 10 years, helping businesses save through the scheme and helping employees get their dream bike for less.

To get the Cycle to Work scheme up and running for your business, simply get in touch

Latest employee benefits resources

Our employee benefits resources offer advice and guidance from industry experts on a range of topics, drawing on our years of experience and expertise in employee benefits.