Solicitor recruitment and conduct: Is employee and candidate screening important for law firms?

Law firms can face substantial criminal sanctions for failing to screen employees as required by the Money Laundering Regulations (SRA “Regulations”). This can be a very hot potato for some law firms, as many tend to shy away from asking for, and providing, detailed references that include specifics regarding the sub-standard behaviour of former solicitors, and other staff, for fear of being sued for ‘saying the wrong thing’ (something which does not carry criminal sanctions).

In this article, we explore solicitor recruitment and employee screening conduct obligations of law firms and how to stay compliant.

The current status of candidate and employee screening in law firms

We recently asked a number of law firm executives at a recent webinar poll if they were carrying out ongoing employee screening for solicitor recruitment. Alarmingly, over half said they weren’t (53.57%). Many simply are not aware of the requirement, or the severity of the risks faced, by not doing so.

Other solicitor polls we have carried out this year so far on the same subject have highlighted that 85.19% of respondents did not receive references that provided useful information about a person’s past conduct and character.

At the recruitment stage, our polls suggest that the following are being checked:

- 74% - qualifications

- 74% - regulatory records

- 89% - employment references

- 74% - DBS checks

- 30% - other checks

The poll data around references should be a real concern for leaders and partners of law firms. With so few finding the legal sector reference regime useful, it begs the question is it completely broken and irrelevant for legal businesses doing their best to reduce risk and remain compliant with relevant regulations?

The financial sector has introduced mandatory reference requirements for those fulfilling senior management and compliance roles; so it begs the question, ‘if it is good enough for the finance sector, why not for the legal sector?’.

We have found an average of 56% of the firms polled on this subject saying they believe the request and supply of detailed employee references should be made mandatory for the legal profession, and 44% saying it shouldn’t. This response is surprising considering the criminal sanctions that firms face.

The Regulations place an obligation on firms to carry out ongoing screening of existing employees. As outlined above our poll results told us that 53.57% of firms surveyed were not currently undertaking such screening. This again is concerning as it clearly shows a high level of non-compliance in a key area of the updated Regulations.

Where could law firms be in breach of the Solicitors Regulation Authority’s Codes of Conduct?

Law firms have a number of obligations they need to consider when looking at employee screening, for example:

- SRA Principles – upholding the public trust and confidence in legal services and acting with integrity.

- SRA Code of Conduct – complying with regulatory arrangements, maintaining records to demonstrate compliance, managing material risks, and duties of compliance officers for legal practice (COLP) to ensure compliance.

1. Accreditation obligations

Law firms that hold accreditations will have other obligations that in effect enhance the regulatory obligations:

- Lexcel – firms must have procedures to deal effectively with recruitment, which must include references and ID checking, and where appropriate, the checking of disciplinary records.

- Conveyancing Quality Scheme (CQS) – firms are required to ensure that all staff covered by CQS are subject to Disclosure and Barring Service (DBS) checks.

2. Money Laundering Regulations

The SRA's Money Laundering Regulations Regulations require law firms within the regulated sector (subject to the size and nature of the business) to screen relevant employees before an appointment is made and during the course of their employment; best practice says that all regulated firms should undertake screening, no matter how big they are or the nature of their business due to the lack of clarity around which firms would be covered by the ‘size/nature’ exclusion.

In terms of what should be covered during screening, the following would be a good start:

- Skills

- Knowledge

- Conduct

- Integrity

Effective pre-employment screening is likely to include the checking of:

- Qualifications – do they really have the qualifications they profess to have?

- Regulatory/disciplinary records – does the SRA Digital Register raise any concerns?

- Employment references – if provided, do they raise any concerns?

Effective ongoing screening is likely to include the checking of:

- Competency records – is the employee competent to carry out their role?

- AML training – has the employee undertaken training relevant to their role and AML responsibilities?

- Appraisal reports – have any concerns been raised about an employee’s suitable to undertake work covered by the Regulations?

Discover our AML guide for law firms to receive expert, practical guidance on how to ensure your law firm is following AML obligations and managing risk well.

3. Employment references

The provision of employment references is optional, however, if they are provided, they must be fair, accurate and not misleading.

Due to the potential risks associated with providing references, as mentioned, many firms choose not to provide them, however, such risks are very low as long as best practice guidelines are followed. For example, if an employee’s performance record shows they need to improve the reference can’t say they excelled at the job.

There have been numerous cases of employees forging references in order to obtain jobs, so it is important to check that they match things like the employee’s curriculum vitae (CV). Our advice is - if in doubt, call the previous employer and clarify matters.

4. Enhanced DBS checks

Many firms think that they can’t/shouldn’t carry out enhanced DBS checks on their employees, however, where they work with children and/or vulnerable clients an enhanced check may be more appropriate than the basic checks carried out on all solicitors on approval by the Solicitors Regulation Authority, for example:

- Working with elderly, ill or disabled adults where you are conducting their affairs or are their representative

- Working with children where you are giving legal advice

5. Insurance obligations

The insurance market has taken a real battering over the last few years due to Covid-19 and other natural disasters, and as a consequence insurers expect firms to do all they can to reduce their exposure to risk, for example, internal fraud.

Many insurers require firms to confirm that they seek references for new staff, with some now requiring new solicitors to complete declarations about their backgrounds and whether they have any regulatory findings against them.

6. Fake references

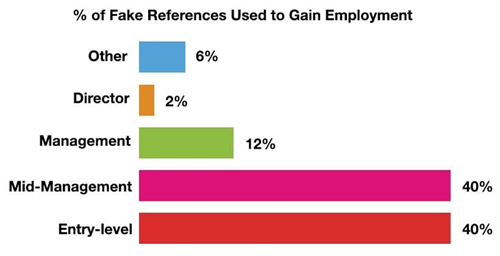

A survey carried out by the BBC/Federation of Small Businesses of 1,000 companies found that 17% of employees had provided fake references, with 67% being from males and 33% from females; 70% of companies were unaware that fake reference services were available. Those providing fake reference were found to be:

Severe risks for law firms

Screening potential and existing employees should be a key risk mitigation step for any business, but even more so for such a highly regulated sector as the legal profession. Any law firm owner or leader that does not realise the severity of the risks they are taking in terms of criminal sanctions, should avoid HR box-ticking at all costs!

Our legal software solutions are designed to help law firms instantly deliver better client outcomes and ensure optimum compliance across the organisation. Our suite of legal software includes everything from cloud-based case and practice management, finance and accounting, compliance and learning through to HR and CRM. Download a brochure or book a free demo to find out more.