How employers are supporting financial wellbeing in 2025 and where they’re falling short

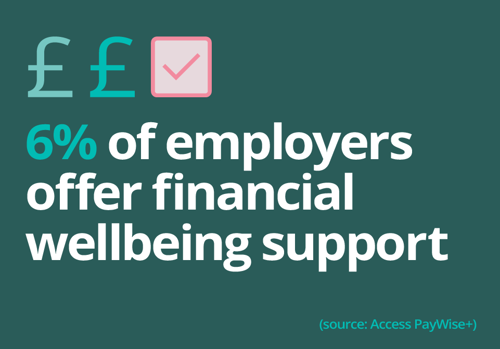

In 2025, nearly one in three of UK employees say financial stress is impacting their work. Yet, fewer than 6% of employers offer even the most basic financial wellbeing support, according to new research from Access PayWise+.

Financial wellbeing benefits are essential for both employees and employers. Money worries can damage mental health, reduce productivity, and lead to absenteeism or presenteeism- where staff are physically present but mentally disengaged.

Despite this, Access PayWise+ research reveals widespread reluctance among employers to invest in financial wellbeing programmes. This mirrors previous findings, such as Trinity Bridge's 2023 report showing only half of UK companies had a financial wellbeing strategy in place.

In today's economic climate, tight budgets and scepticism about ROI often hinder progress. However, the business case for investing in financial wellbeing is clear and compelling.

According to Deloitte, poor mental health - often linked to financial stress - costs UK employers £51 billion annually. Yet, for every £1 spent on mental health and wellbeing support, employers see an average return of £4.70 in productivity, an ROI of over 400%.

With rising costs affecting both employees and businesses, supporting financial wellbeing is not just a moral imperative - it's a strategic one.

What Financial Wellbeing Benefits Are Employers Offering in 2025?

To understand the current landscape, Access PayWise+ analysed job ads across 30 UK sectors, identifying 21 financial wellbeing benefits grouped into seven categories:

- Financial compensation & pay enhancements: Annual pay reviews, overtime, bonus schemes, earned wage access (EWA)/EarlyPay PayWise+ app.

- Retirement & long-term savings: Enhanced pension contributions, share schemes.

- Work from home (WFH)

- Lifestyle support: Train season ticket, cycle to work, retail discounts.

- Family & parental benefits: Enhanced maternity & paternity pay, childcare vouchers.

- Health & wellbeing: Employee assistance programme (EAP), private healthcare, discounted gym membership, wellbeing day.

- Insurance & protection: Life assurance, income protection, critical illness, death in service.

Top Sectors for Financial Wellbeing Benefits in 2025

Motoring & Automotive leads the way, ranking in the top ten for six out of seven benefit categories. It excels in lifestyle support and family benefits, offering enhanced maternity/paternity pay and childcare vouchers. It also tops the list for financial compensation, thanks to widespread overtime and bonus schemes. However, it lags in remote work options - likely due to the nature of the roles, which are often site-based or require physical presence.

The Training sector ranks second, performing well in retirement savings, WFH, family benefits, health & wellbeing, and insurance. However, it could improve its offering of lifestyle and financial compensation benefits, such as bonus schemes and more financial management initiatives.

Security & Safety comes third, topping the list for share schemes and ranking highly in health, family, and insurance benefits. Its weakest areas are WFH and lifestyle support, which may reflect the operational nature of many roles in this sector.

Social Care ranks fourth, offering strong health & wellbeing support, including EAPs and gym discounts. It also performs well in financial compensation, including earned wage access, lifestyle support, and insurance, but lacks retirement savings options and remote work flexibility - understandably so, as many roles require staff to be physically present in care settings.

Energy rounds out the top five, offering generous family benefits and strong compensation and insurance support. However, it falls short in retirement savings, particularly share schemes.

Which Sectors Fall Behind?

Education ranks lowest, offering minimal financial wellbeing support - likely due to limited funding and investment. While some teachers can access targeted incentive payments for teaching in eligible state-funded secondary schools for the academic year, broader support is lacking.

Recruitment Consultancy comes second-last, offering few benefits beyond train season tickets. While this can be a very useful financial benefit for commuters, independently, this falls short of a holistic financial wellness package.

Admin, Secretarial & PA roles rank third-lowest, with limited offerings across all categories.

Media, Digital & Creative ranks fourth-lowest, likely due to low pay, freelance work, and project-based employment. This is likely due to a combination of factors such low-pay, project-based work affecting cash-flow, and prevalence of freelancers.

Scientific roles round out the bottom five, with weak offerings in most categories except pension contributions.

What Are the Most Common Financial Wellbeing Benefits in 2025?

Employers tend to favour benefits that offer financial security and flexibility, and preference for low-cost, high-impact options that support both employee wellbeing and business efficiency.

Life assurance was revealed as the most common financial wellbeing benefit on offer, with 5.9% of job ads on average stating this in their description. This benefit provides vital financial security for beneficiaries in the case of an employee's death, at a relatively low and tax efficient cost for businesses - likely most popular for being mutually beneficial.

Overtime followed close behind, with 5.1% of job listings stating this as a benefit. Despite being the second most common benefit, UK workers did £31 billion worth of unpaid overtime in 2024, highlighting clear room for improvement in this area. Sacrificing work life balance has direct links to burn out, and should be compensated for as standard across all sectors.

Work from home sits in the top three most popular financial wellbeing benefits offered by companies. The proportion of hybrid workers has increased gradually from 2022, with more than a quarter of the UK workforce hybrid working in the first quarter of 2025. Work from home allows flexibility, for working families to save on childcare costs.

What Are the Least Offered Financial Wellbeing Benefits in 2025?

Some benefits remain rare, despite their potential impact:

Childcare vouchers are especially scarce, despite rising nursery fees and limited government support. EWA, which gives employees more control over their finances, is also underutilised.

What Can Employers Do to Improve Employee Financial Wellbeing?

A CIPD survey found that 59% of employees believe it's important for their employer to have a financial wellbeing policy. When job hunting, 65% say it's a key consideration. This further demonstrates a strong business case for investing in the financial wellbeing of workers, for productivity and retention.

Commenting on the findings, Abhishek Agrawal at Access PayWise+, said:

“Employers who offer comprehensive financial wellbeing benefits will likely see greater productivity and loyalty, while attracting top talent. With only 6% of job ads offering even the most common benefit - life assurance - there's clear room for improvement

“Previous Access PayWise+ research showed that 80% of employes using earned wage access felt more loyal to their employer, and 46% said they'd take on more shifts. Yet, EWA remains overlooked.

“Businesses have a real opportunity to improve their financial wellbeing offering. Many benefits, like cycle to work schemes and life assurance, come at little cost but deliver big impact. Investing in financial wellbeing is a strategic move that supports growth, retention, and profitability.”

Methodology

Access PayWise+ used Reed data to analyse financial wellbeing benefits listed in UK job descriptions across 30 sectors. Researchers identified benefits using keywords, grouped them into seven categories, and ranked sectors on an index from 0 to 100 based on total category scores. Higher scores indicate stronger financial wellbeing support. Data accurate as of September 2025.

Frequently asked questions

What is employee financial wellbeing and why does it matter?

How are UK employers currently supporting financial wellbeing?

Research shows fewer than 6% of employers offer even basic financial wellbeing benefits, despite one in three employees reporting financial stress impacts their work.

What are the most common financial wellbeing benefits offered by employers?

Life assurance (5.9%), overtime pay (5.1%), and flexible work options are among the most common benefits, but many impactful options like childcare vouchers and earned wage access remain underutilised.

Which sectors lead in financial wellbeing support?

Motoring & Automotive, Training, and Security & Safety rank highest, while Education and Recruitment Consultancy lag behind.

What is the ROI of investing in financial wellbeing programmes?

For every £1 spent on wellbeing support, employers see an average return of £4.70 in productivity, a 470% ROI.

Ready to improve employee retention?

Book a demo now.

AU & NZ

AU & NZ

SG

SG

MY

MY

US

US

IE

IE