Pay and Bill

Pay and Bill

ANZ specific Payroll and Billing software for recruitment agencies

Robust and reliable payroll and billing software solutions built specifically for recruiters, to help your back-office recruitment finance team be more productive.

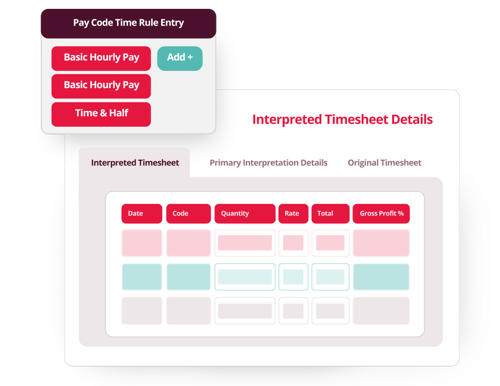

Our pay and bill software, powered by Access FastTrack360, now includes Multi-Period Payroll, which consolidates current and historical pay runs into a single batch. This reduces manual input, enhances your compliance, and improves your cash flow.

What you need to know about our recruitment agency payroll software

Purpose-built for labour hire, temp, and staffing firms to pay and get paid effortlessly.

Struggling with cash flow visibility? This guide can help.

Get ahead of late payments, payroll pressure, and compliance risk. This free playbook reveals how recruitment finance leaders are modernising their back office to gain control and scale with confidence.

Pay and Bill FAQs

What is pay and bill software for recruitment agencies in Australia and New Zealand?

Pay and bill software automates the full workflow from timesheet capture to payroll processing and client invoicing. It’s designed for ANZ recruitment agencies to handle award interpretation, GST compliance, and on-time payments with ease.

This is just some of what we think is a key functionality, but what will start to Pay and Bill from the back office and into the heart of the business.

How does this software ensure compliance with Fair Work and IRD regulations?

In Australia, the software automates compliance with Fair Work awards, Superannuation, Single Touch Payroll (STP), and ATO requirements. In New Zealand, it supports KiwiSaver, IRD filings, and holiday pay calculations, reducing manual errors and audit risks.

Can it handle complex awards and enterprise agreements?

Yes. The platform is built for agencies dealing with multiple Modern Awards, EBAs, site allowances, and varying charge rates—common in industries like construction, healthcare, and aged care.

Does the system support weekly payroll cycles for temps and contractors?

Absolutely. Weekly payroll is standard in ANZ labour hire and temp recruitment. The software is designed to handle high-frequency, high-volume payroll runs without manual effort.

How does FastTrack360 handle payroll adjustments and backdated payments?

With Multi-Period Payroll (MPP), you can process current payroll and multiple adjustment periods in a single batch run.

This eliminates the bottleneck of creating numerous separate adjustment batches, saving your finance team hours of processing time. The system automatically includes terminated employees with backdated transactions and allows concurrent batch processing, so you're no longer constrained by one-batch-at-a-time limitations.

Ideal for agencies dealing with late timesheet submissions, award adjustments, and complex pay scenarios.

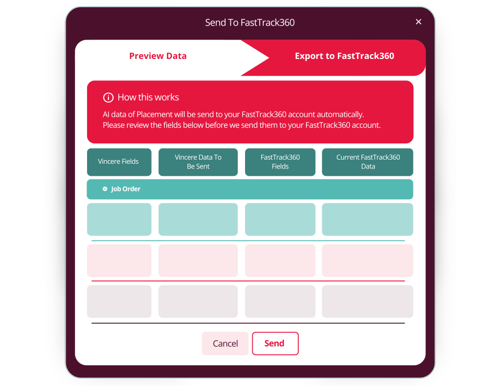

Is this software compatible with recruitment CRMs and accounting systems?

Yes. It offers seamless integration with leading CRMs like Vincere and accounting systems like MYOB, Xero, eliminating double data entry between your front and back office.

How does pay and bill automation improve cash flow visibility?

With real-time syncing of timesheet, pay, and invoice data, you get instant visibility into gross margins, on-costs, and invoice status—helping you manage cash flow and client billing more effectively.

What types of recruitment businesses is this suited for in ANZ?

Ideal for labour hire and temp staffing firms in sectors like construction, mining, healthcare, logistics, and manufacturing across Australia and New Zealand.

How long does it take to implement recruitment pay and bill software?

Most agencies can get up and running in 8 - 12 weeks, depending on complexity, data readiness, and integration needs. Local support teams help ensure a smooth transition.

Discover how to select pay and bill software for your recruitment agency

Recruitment technology that plugs into one innovative platform

From software products designed to solve key challenges, to a fully integrated solution:

- Attract new clients and candidates with Access Attract Evo.

- Manage your operations at every stage, interaction and opportunity from our Recruitment CRM and overhaul manual efforts by adding Access Automate to the mix, growing your operations without more heads.

- Onboarding through the best experience for candidates and clients with Onboarded.

- Pay and get paid with speed, accuracy and confidence with Access FastTrack360's sophisticated pay and bill solutions.

Discover how Access can help your entire recruitment business become more productive and efficient – giving you the freedom to focus on clients and candidates.

UK

UK

SG

SG

MY

MY

US

US

IE

IE