Staffing Industry Analysts (SIA) projects the Australian market will remain flat in 2025 before returning to 3% growth in 2026. But that growth won't be evenly distributed. The agencies pulling ahead are those treating AI as core infrastructure, not an experiment, while adapting to local compliance realities and a fundamentally changed labour market.

Here are five trends defining the ANZ recruitment landscape in 2026.

1. AI Becomes Core Infrastructure (Not a Bolt-On)

The conversation has shifted. In 2024, agencies asked, "Should we use AI?" In 2026, the question is "How deeply is AI embedded across our operations?"

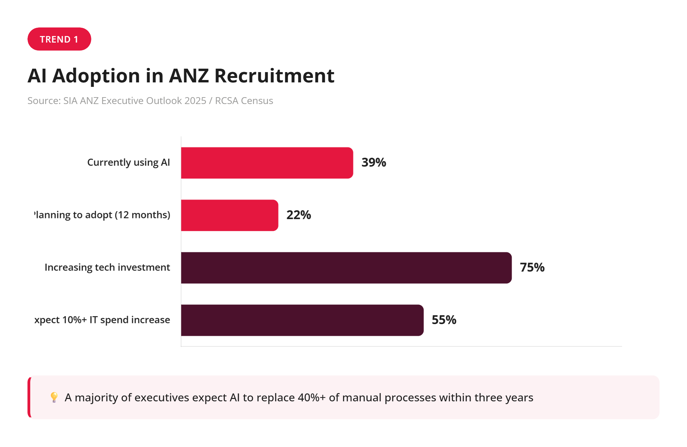

According to SIA's ANZ Staffing Executive Outlook, 75% of ANZ staffing executives expect to increase investment in technology and automation this year, while only 5% plan to decrease it. More striking: a majority expect AI to replace at least 40% of today's manual processes within three years.

This isn't speculative. The adoption is already underway. According to the RCSA Industry Census 2025, 39% of recruitment professionals are already using AI to automate parts of the recruitment process, with an additional 22% planning to start within the next 12 months.

Globally, AI adoption in HR and recruiting grew from 26% in 2024 to 43% in 2025, a 68% increase in a single year. The technology is reducing time-to-hire by up to 50% and cost-per-hire by 33%.

But here's what separates leaders from followers: integration versus isolation. Standalone AI tools create fragmentation and compliance risk. The agencies seeing returns are embedding intelligence directly into CRM, candidate matching, and analytics workflows, not bolting on disconnected point solutions.

"We're starting to use AI across core recruitment workflows from comparing CVs to job descriptions, to editing job ads and anonymising company names, salaries, and locations before posting roles."

— Raj Atwell, Recruiter, White Recruitment

The bottom line: AI investment is now table stakes in ANZ. The differentiator is how securely and deeply it's embedded across your operations.

2. Data Privacy Is the New Competitive Differentiator

Here's a stat that should get every ANZ recruitment leader's attention: according to SIA's ANZ Executive Outlook, data privacy is the #1 compliance concern for 70% of staffing executives in the region—and concern about AI specifically has more than doubled, jumping from 20% to 45% year-on-year.

This isn't paranoia. It's recognition of where the regulatory environment is heading.

In January 2025, the Office of the Australian Information Commissioner (OAIC) released guidance requiring human oversight for AI in recruitment. The following month, the Australian Parliament's Future of Work Report recommended classifying AI in recruitment as "high-risk", a designation that would trigger stricter obligations under the Privacy Act 1988.

For agencies operating across the Tasman, New Zealand's Privacy Act 2020 adds another compliance layer. And those with global clients are watching the EU AI Act closely, as it already classifies recruitment AI as high-risk, with fines of up to €35 million or 7% of global turnover.

"Our data is secure within Vincere. With public AI tools, there's a risk that data could be exposed to open learning systems. We don't want competitors learning about our business, what we do, or the clients we're working with."

— Raj Atwell, Recruiter, White Recruitment

The bottom line: Privacy isn't just a compliance checkbox. It's a competitive advantage. Agencies that can demonstrate secure, auditable AI usage will win enterprise clients increasingly focused on supply chain risk.

3. Skills-Based Hiring Accelerates But Execution Lags

The rhetoric around skills-based hiring has reached a fever pitch. According to TestGorilla's 2025 State of Skills-Based Hiring report, 85% of employers now use skills-based hiring practices—up from 81% the previous year and 73% in 2023.

But here's the uncomfortable truth: policy is outpacing practice. Research from Harvard Business School and Burning Glass Institute found that while companies publicly removed degree requirements, fewer than 1 in 700 hires were actually affected. The gap between what organisations say and what they do remains significant.

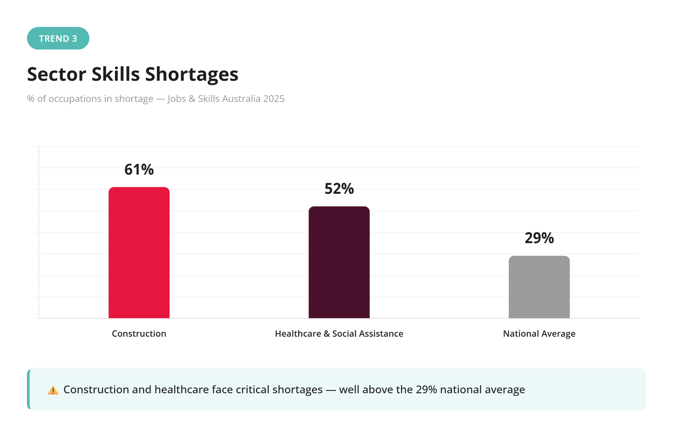

In ANZ specifically, the pressure to close that gap is intensifying. SIA's Australia Market Overview reports that 29% of Australian occupations were in national shortage in 2025. That's down from the 36% peak in 2023—but still elevated. Construction (61% of workforce in shortage), healthcare and social assistance (52%), and trades remain the hardest-hit sectors.

Long training gaps, where few qualified applicants exist due to lengthy training pathways, account for 33% of occupational shortages. You can't solve a five-year training deficit with a six-month recruitment campaign.

This is where skills-based hiring becomes genuinely strategic. The Hays 2025 Skills Report found that 86% of AU/NZ hiring managers have shifted focus to skills-based hiring specifically to address market gaps.

The World Economic Forum projects that if the global workforce consisted of 100 people, 59 would require training by 2030. That's not a hiring problem; it's a capability development challenge.

The bottom line: Skills-based hiring is no longer optional, but execution requires tools that match capabilities to requirements, not just keywords to job titles.

4. The Rise of Integrated Recruitment Ecosystems

The Australian recruitment services market is valued at $20.6 billion with 8,518 businesses (IBISWorld 2025). It's a fragmented landscape where many agencies have accumulated a patchwork of point solutions over time—one tool for sourcing, another for engagement, a third for analytics.

The problem? AI delivers value when data flows. It struggles when trapped in silos.

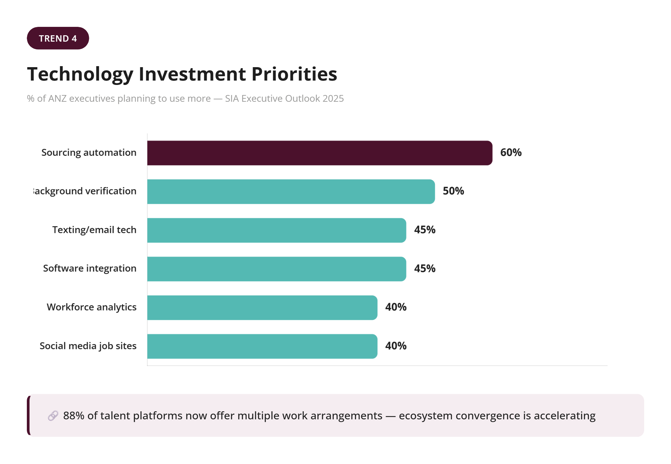

SIA's research shows the vendor technology categories seeing the highest growth in ANZ: 60% of executives plan to use more sourcing automation tools, followed by background verification (50%), software integration (45%), and texting/email technology (45%).

Notice what's at the top: sourcing automation and integration. Agencies aren't just buying more tools; they're looking for tools that connect.

This reflects a broader industry shift SIA calls "Everything is Merging." Boundaries between staffing firms and staffing platforms are blurring. Talent platforms that once served only freelancers now offer multiple work arrangements 88% offer more than one type, up from 67% in 2021.

"For us, it's all about how we integrate Access into the other tools we use, and making sure everything is working together."

— Mark Morby, Director of Operations, Danos Group

The bottom line: Integrated ecosystems in which CRM, sourcing, marketing, and analytics share data are where AI delivers commercial insights. Point solutions create silos; ecosystems create competitive advantage.

5. Regional and Sector Shifts Are Reshaping Opportunity

The growth isn't uniform, and smart agencies are following the heat.

In Australia, regional markets are outperforming metro markets. Jobs & Skills Australia data show that 55% of regional employers are actively recruiting, compared with 50% in metropolitan areas. South Australia recorded the strongest employment growth nationally, while Western Australia remains tight for trades and engineering roles.

Sector-wise, the winners are clear. Healthcare and Social Assistance saw the largest employment growth, 177,600 jobs, in the year to June 2025. Construction job vacancies increased 20% quarter-on-quarter in May 2025, the largest quarterly jump across all industries.

Migration is filling gaps. "Chef" was the most granted skilled visa occupation in the year to March 2025, with 3,920 visas granted (up 160.5% year-on-year). Net migration rebounded to 110,000 workers in Q1 2025. Global hiring is now a core strategy, not a fallback.

M&A activity reflects these shifts. SIA reports that 45% of ANZ staffing executives are considering some form of M&A, many seeking to acquire capability in high-growth sectors or regions.

The bottom line: The agencies capturing the largest share in 2026 are those that specialise by sector or region and build (or acquire) capability where demand is heading.

The Hidden Trend: Culture as Competitive Advantage

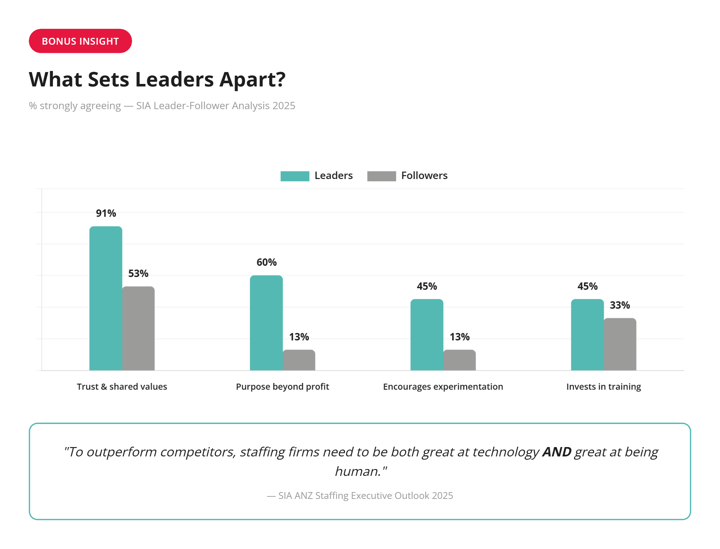

Amid the focus on technology, one finding from SIA's research stands out. When comparing firms that expect to outperform ("leaders") versus the rest of the market ("followers"), the biggest gaps weren't in technology adoption; they were in culture:

- 91% of leaders foster a culture of trust and shared values vs 53% of followers

- 60% of leaders have a clearly defined purpose beyond profit, vs 13% of followers

- 45% of leaders encourage experimentation vs 13% of followers

SIA's conclusion: "To outperform competitors, staffing firms need to be both great at technology AND great at being human." The agencies investing only in tools without corresponding investment in culture, training, and purpose are missing half the equation.

What This Means for ANZ Agency Leaders

The ANZ recruitment market in 2026 rewards agencies that can hold multiple priorities simultaneously:

- Embed AI deeply but within secure, compliant environments that protect client and candidate data.

- Adopt skills-based hiring, using tools that translate policy into practice and match capabilities to requirements, not just keyword matching.

- Integrate your tech stack because AI delivers value when data flows across CRM, sourcing, and analytics, not when it's trapped in silos.

- Follow the growth of regional Australia, healthcare, construction, and technology, where the opportunities concentrate.

- Invest in culture because the agencies outperforming aren't choosing between technology and humanity. They're investing in both.

Growing revenue and market share remain the #1 management priority for 75% of ANZ staffing executives. But 70% are also increasing investment in staff training and upskilling, recognising that sustainable growth requires capable people, not just capable systems.

The market is projected to return to 3% growth in 2026 after a flat 2025. That growth will go to the agencies that have spent the quiet period building technological and human infrastructure to accelerate ahead.

Ready to build the infrastructure for 2026 and beyond?

The ANZ recruitment market is returning to growth, but the gains won't be evenly distributed.

Agencies that invest now in secure AI integration, connected tech stacks, and skills-based matching will capture a disproportionate share of the market as demand accelerates. Those still running fragmented point solutions and manual workflows will struggle to keep pace.

Access Recruitment's AI software brings together CRM, candidate sourcing, marketing automation, and enterprise-grade AI across a single connected ecosystem purpose-built for recruitment agencies ready to scale. No data silos. No compliance gaps. Just the infrastructure you need to compete.

Request a demo and see how leading ANZ agencies are building for what's next.

UK

UK

SG

SG

MY

MY

US

US

IE

IE