Access FastTrack360 The smarter way to run your back office

Effortlessly pay, bill and invoice in seconds. A seamless, end-to-end experience—exactly what your team deserves.

Trusted by businesses in Australia and New Zealand

Fuss-free payroll and billing – as it should be

How FastTrack360 recruitment software has helped customers

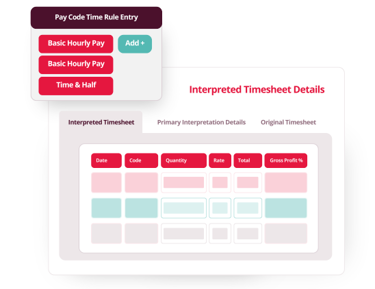

Automated time interpretation

- Workers log their hours, and our advanced time interpretation engine handles pay, overtime, and allowances while automatically generating client invoices.

- FastTrack360 allows you to validate calculations before they reach payroll and billing, reducing errors by up to 90%.

Rapid pay & efficient billing

- Manage billing effortlessly with a configurable system that calculates profit and bill rates while handling invoices across currencies and business levels.

- Generate tailored invoices quickly based on your preferred cycles and formats to speed up payments.

- Run payroll and billing on independent cycles, offering flexibility and scalability as your business expands.

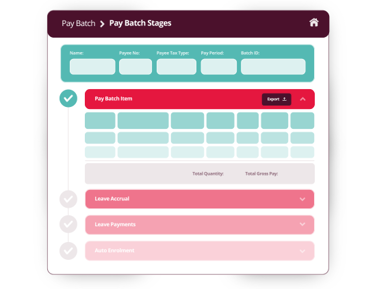

Real-time payroll processing

- Run multiple payrolls within the same pay period, accommodating various frequencies and multiple runs with ease.

- Provide a real-time, highly visual payroll process, allowing your team to identify and fix issues as they occur.

- Automate pension auto-enrolment to stay compliant, with seamless integration to providers like Superannuation and KiwiSaver.

- Manage multiple tax types in one system, including PAYG, PAYE, Contractor engagement and off-payroll workers.

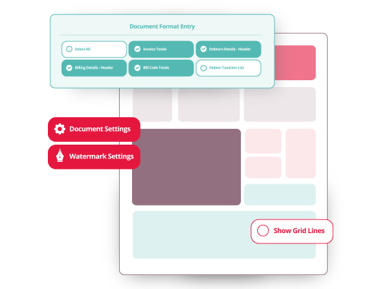

Customisable branding

- Customise payslips and invoices to align perfectly with your brand, with no extra costs for hard-coded designs.

- Use multiple designs for different payee types or billing companies, ensuring your brand is consistently represented.

- Consolidate billing operations on a single platform with FastTrack360, ideal for agencies managing multiple brands or scaling up.

Book a demo

Complete the form to request a personalised demo of and see for yourself how Access FastTrack360 could transform your business

Access FastTrack360 is a powerful cloud-based system that effortlessly captures timesheets, calculates pay and creates invoices all online for your contractor workforce.

By bringing together your time, pay and bill processes, Access FastTrack360 is highly configurable get results sooner for you, your candidates and your clients.

Success Stories

Access FastTrack360 FAQs

Which CRMs does FastTrack360 integrate with?

FastTrack360 integrates with major CRMs, such as Vincere, Bullhorn and JobAdder. This means you can quickly and securely transfer data between your systems, while streamlining your timesheets, payroll and billing operations and reducing the risk of manual errors.

What tax types does FastTrack360 support?

FastTrack360 manages multiple tax types simultaneously, including off-payroll worker, PAYE, CIS, contractor, Umbrella, and Managed Agency. This gives your agency complete flexibility in how to manage your current operations and also supports your expansion into new recruitment markets as you expand.

What are the benefits of FastTrack360 over a generic payroll solution?

Payroll and billing software is essential for recruitment agencies, so that you can manage every aspect of your business, from paying your workforce to billing clients quickly and accurately.

A dedicated payroll and billing solution, such as FastTrack360, is designed to support the unique requirements of recruitment agencies. This includes managing multiple tax types to accommodate different types of workforces, and enabling you to invoice clients in seconds. FastTrack360’s unique time interpretation engine automatically calculates pay based on pre-determined rules, significantly reducing the amount of work for recruitment payroll teams.

FastTrack360 integrates with major recruitment CRMs, such as Vincere, Bullhorn and JobAdder, so you can automate timesheet collection, pay workers and bill clients quickly and accurately.

It will help to ensure you remain compliant with your obligations, including Award and Agreement, PAYG tax compliance, Payroll tax and Superannuation etc.