What are the biggest issues in the US construction industry? – and how to tackle them

The US construction industry faces huge challenges in 2024 and beyond. With fluctuating interest rates, the fallout of inflation and unprecedented labor shortages, the outlook can look bleak. However, the sector continues to thrive, with the value of US construction in 2023 totaling over $1,987.7 billion, 7% above the $1,848.7 billion spent in 2022.

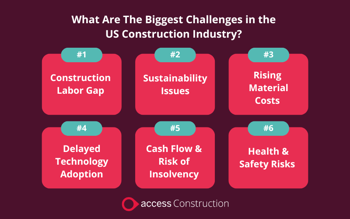

The key to not getting blindsided by industry challenges is to be diligent and well-informed. With that in mind, we outline some of the biggest issues in the US construction industry today, and how to navigate them successfully.

What are the main issues in US construction industry?

1.The labor crunch in construction

Many of the industry’s challenges today seem to stem from the labor shortage in construction. With highly fluctuating labor costs, project delays and supply chain instability, the skill shortage is arguably the biggest challenge facing construction.

As per ABC's recent report, there is a notable demand for skilled construction workers, with 459,000 job openings currently available. This figure marks the highest level of unfilled construction positions since 2022.

The huge gap between labor availability and demand is rapidly growing. According to AGC’s outlook survey for 2023, 69% of contractors planned to hire in the upcoming year, while only 11% anticipated reducing their workforce. To achieve these lofty goals amid the labor crunch, approximately 72% of respondents say they were raising base pay rates in 2022, with around a third also enhancing bonuses and benefits.

A perceived lack of young people interested in construction work means each experienced worker that retires leaves a significant skill gap. Sixty-one percent of the current construction workforce is set to leave the industry in the next decade. Essential trade skills are lost each time an employee retires, but projects are increasing in complexity and demand. This forces businesses into outsourcing talent, which has a knock-on effect on project budgets.

But steps can be taken to try and mitigate the long-term effects of labor crunch.

By focusing and investing in skills development for current employees, seeking out and mentoring students and graduates or offering apprenticeship programs may also encourage younger talent to show interest in the industry once more.

Showing progression in the adoption of technology, sustainability and diversity will also go a long way in making construction more desirable for this more conscientious generation. All this will help the next generation of workers to overcome their stigmatized view on construction.

2.The need for sustainability

The construction sector is under mounting pressure to embrace environmentally friendly practices, driven by evolving environmental regulations and shifting consumer preferences. According to the United Nations Environment Program (UNEP), the construction industry is the leading contributor to greenhouse gas emissions, responsible for almost 37% of total emissions. With these results aligning with global initiatives such as the International Energy Agency’s Net Zero Emissions by 2050 Scenario.

Today, businesses are adopting and enhancing more efficient processes and methods to build, demolish and deconstruct their infrastructure. According to UNEP, investments in building energy efficiency amounted to $237 billion between 2020 and 2021.

Additionally, major businesses are now exploring further strategies, including the electrification of their vehicles, the utilization of renewable energy sources like wind and solar, and transitioning to paperless operations.

The demand for more sustainable materials has already seen an increase and this is forecast to continue. However, a push for net zero in the industry is not all bad. Younger generations show a keen interest in sustainability which could help with labour shortages and presents an opportunity to plug the skills shortage gap.

3.Rising material costs

Material costs have long been a main concern in the construction industry, impacting project budgets, timelines, and overall profitability. In 2024, this challenge has been exacerbated by various factors, ranging from supply chain disruptions to global economic shifts.

Understanding the factors driving material cost increases

- Supply Chain Disruptions: The COVID-19 pandemic highlighted vulnerabilities in global supply chains, causing disruptions in the availability and delivery of construction materials. Although many economies are on the path to recovery, these disruptions have persisted, contributing to ongoing material shortages and increased costs.

- Increased Demand: As economies rebound and infrastructure projects resume, the demand for construction materials has surged. This heightened demand, coupled with limited supply, has led to bidding wars and price escalations, further driving up material costs.

- Inflationary Pressures: Inflationary trends, influenced by monetary policies, geopolitical tensions, and other macroeconomic factors, have also played a role in pushing up material prices. Rising energy costs, for example, can directly impact the production and transportation expenses associated with construction materials.

Strategies for tackling rising material costs

- Strategic Sourcing: Construction companies are increasingly diversifying their supplier base and exploring alternative sourcing options to mitigate the risk of material shortages and price volatility. Establishing long-term relationships with reliable suppliers and leveraging technology for real-time supply chain visibility can help in this regard.

- Value Engineering: Adopting value engineering principles involves optimizing project designs and specifications to achieve cost savings without compromising quality or performance. By re-evaluating material choices, construction methods, and design elements, stakeholders can identify opportunities to reduce overall material costs while maintaining project integrity.

- Investing in Technology: Embracing digital tools and construction technology can enhance efficiency and productivity throughout the project lifecycle. Advanced project management software, Building Information Modeling (BIM), and procurement platforms can streamline workflows, optimize resource allocation, and facilitate better decision-making, ultimately mitigating the impact of rising material costs.

- Contractual Flexibility: Incorporating clauses and provisions in construction contracts to address price fluctuations and supply chain disruptions can provide a degree of financial protection for project stakeholders. Negotiating flexible payment terms, establishing escalation clauses tied to material indices, and incorporating contingency plans for alternative material sourcing can help mitigate risks associated with volatile material markets.

Future-Proof Your Construction Business With Access COINS ERP

Access COINS is an ERP system designed to tackle major issues within the construction industry, from tracking cash flow, increasing employee retention with HR and Payroll tools and providing visibility across large, complex projects.

4.Delayed technology adoption in construction

The construction industry is notoriously hesitant to adopt new methods and technologies. This often comes down to businesses not having the time or budget to teach staff new ways of working.

The McKinsey Globe Institute named construction the second least digitized sector in the world.

Haphazard document management is a major issue associated with slow technology adoption. Tracking and managing the vast number of documents produced through each project is a laborious administrative task.

Manually managing documentation is slow and leaves room for human error. Moving to a paperless centralized data system standardizes data and gives everyone a more accurate view of each project. Efficient digital document management also allows for in-depth analysis, improved forecasting and better margins.

While digitalization within the construction industry appears to be gaining momentum, there remains ample opportunity for enhancement.

5. Cash flow and risk of insolvency

Cash flow remains a volatile problem for the construction sector. In fact, 34% of US construction firms report they are currently targeting new technology to help overcome cash application and payment delays.

A steady cash flow is crucial for construction. Your suppliers want to be paid after they have completed their work and do not care if your client has not paid. Having free cash to be able to pay subcontractors and suppliers before the project completion is necessary to avoid disputes, delays and damage to your reputation.

Company owners are often not trained in managing finances and do not have a background in accounting. Financial skills are learnt on the job, and so fund management is a common issue amongst construction firms. Combined with forgetful clients or unreliable subcontractors, a steady cash flow becomes an arduous task.

Unfortunately, late payments represent 12% of the overall construction expenses, compelling one out of every three contractors to cover cash flow requirements and incur additional expenses such as interest charges. It's typical for many to wait beyond 90 days for payment, significantly heightening the risk of encountering cash flow deficits.

A solution to the cash flow problem starts by building a strong business credit profile. There are practical steps to achieve this:

- Set up project bank accounts where money is held in escrow.

- Make sure paperwork and contracts are all in order with necessary signatures.

- If a client requests a change mid-project, make sure you have written signed agreements that can be referred to.

- Choose reliable subcontractors by asking suppliers or subcontractors you regularly work with to give recommendations.

- Check licenses and insurance before finalizing a hire.

- Take every opportunity to build networks and upskill employees.

Overall, a healthy cash flow comes down to doing your research and surrounding the business with people you trust.

6. Health and safety risks

In 2021, construction was ranked as the most dangerous industry to work in.

Despite health and safety initiatives, the nature of the work in the industry implies a significant possibility of an injury happening sooner or later.

Accidents cause lawsuits and higher insurance premiums, which have a negative impact on a brand reputation and cash flow. Injuries also mean that you will have less available employees, which can be detrimental given the current skills shortage.

Failing to keep on top of health and safety compliance - such as onsite training, equipment compliance and accreditations - can result in fines as well as putting employees at higher risk. One of the main reasons for injuries is poor health and safety training.

The problem is that the majority of on-site construction injuries occur randomly, posing challenges in predicting and pre-emptively addressing them. Therefore, to effectively address this issue, it's imperative to cultivate a safety-centric mindset towards on-site operations. This entails allocating resources towards enhanced protective gear, comprehensive safety training initiatives, and the implementation of proactive safety protocols and software to respond swiftly to potential hazards.

7. The need for more women in construction

The lack of women in construction is a pervasive issue. Despite career opportunities in the industry, many women are put off by its 'macho' stereotype of physical and messy work.

One way of breaking the stigma that 'construction is a man’s job' is through the tone of voice, language and imagery used in recruitment processes. Finding recruitment agencies that can offer advice on diversifying role descriptions in job adverts will help attract a wider pool of talent.

Amid labor crunches such as the ones the industry faces today, marketing the sector to a more diverse audience is a surefire way of overcoming skill gaps.

Although the industry is advancing towards greater inclusion, there remains room for improvement.

In the United States, women comprise approximately 10.9% of the construction workforce, with only an estimated 4% actively working on-site. However, there has been a positive trend since 2011, with a 2% increase in women's participation in the construction sector, marking progress from when they constituted only 8.9% of the construction labor forces.

The opportunity is there. However, the onus is now on companies within construction to seek out and adopt a more diverse approach to recruitment and onboarding. In fact, according to the Bureau of Labor Statistics (BLS), the construction industry is anticipated to grow by at least 4% from 2021 to 2031.

This equates to roughly 168,500 new job opportunities annually over the next decade. With this rapid and sustained growth, companies are increasingly motivated to actively pursue and engage women, recognizing the invaluable skill sets they bring to the construction sector.

This issue also calls for businesses to evaluate their current employees to determine how well they are integrating their more diverse hires into the business. By focusing on fostering an environment that both men and women feel comfortable in, whether that is reviewing current company policies or even offering current employees diversity training.