Customers in payroll may have several fear factors when it comes to embracing AI technology. One major fear is the potential for job loss as AI systems become more efficient in processing payroll tasks. There is also concern about data security and privacy, as AI systems may hold sensitive employee information. Additionally, some customers may worry about the complexity of implementing and integrating AI into their existing payroll systems, fearing potential errors or disruptions. Overall, the fear factors for customers in payroll embracing AI revolve around job security, data protection, and the unknown challenges that come with adopting new technology.

The role of AI in Payroll today

The role of AI in Payroll today is becoming increasingly prominent as it is integrated into payroll systems. AI platforms are able to automate routine calculations, tax deductions, and identify data anomalies with a high level of accuracy and reliability. Through the use of Natural Language Processing (NLP), chatbots are able to interact with employees, answering queries about payslips and leave balances. Additionally, machine learning algorithms can detect suspicious patterns that may indicate payroll fraud, enhancing the overall security of the payroll process. AI is not just about speed; it is also about precision and intelligent decision-making, revolutionising the way payroll is managed in organisations.

Benefits of AI-driven Payroll Solution

The integration of AI into payroll functions offers a range of benefits for businesses. Firstly, AI can streamline and automate the payroll process, saving time and reducing the risk of errors. This, in turn, improves efficiency and accuracy in payroll computations, ensuring that employees are paid correctly and on time. AI can also enhance data security by detecting and preventing potential payroll fraud or breaches. Additionally, AI technology can provide valuable insights and analytics on payroll data, enabling companies to make informed decisions and improve financial planning. Overall, the integration of AI into payroll functions can lead to cost savings, increased productivity, and improved compliance with regulations. Here are the benefits of using Access Evo:

1. Enhanced accuracy and compliance

AI integration in payroll systems significantly reduces manual errors and ensures adherence to local regulations. Access Evo's AI assistant, Copilot, provides intelligent insights and suggests actions based on context, aiding in accurate payroll processing and compliance with Malaysian statutory requirements such as EPF, SOCSO, and EIS.

2. Increased efficiency and productivity

By automating routine tasks, AI allows payroll professionals to focus on strategic activities. Access Evo's personalised Feed aggregates tasks and notifications, enabling users to manage priorities effectively without switching between applications, thus streamlining workflows and enhancing productivity.

According to a study carried out by the McKinsey Global Institute, the increasing use and development of AI technologies could potentially lead to automation assuming up to an additional three hours of daily work by the year 2030. This projection highlights the significant impact that AI safety improvements and wider applications could have on the future of work, potentially freeing up time for workers to focus on higher-level tasks and creativity.

3. Better employee experience

AI-driven payroll solutions offer personalised experiences for employees. Access Evo's mobile accessibility ensures that employees can access their payroll information anytime, anywhere, enhancing transparency and satisfaction.

4. Data security and privacy

With the sensitive nature of payroll data, security is paramount. Access Evo incorporates a 3-Tier Security Model, ensuring that all data remains within a private, secure environment. The system maintains user-specific permissions, ensuring confidentiality and compliance with data protection standards.

5. Strategic decision-making through analytics

AI-powered analytics provide actionable insights for informed decision-making. Access Evo's Analytics tool consolidates data from various sources, allowing for the creation of custom dashboards and reports. This holistic view supports strategic planning and performance tracking.

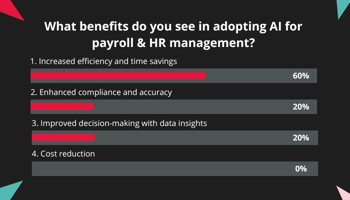

In our recent survey with over 450 participants, it was revealed that the majority of respondents recognised the advantages of integrating AI into payroll and HR processes. The survey results showed that 60% of participants believed that implementing AI could lead to increased efficiency and time savings, while 20% highlighted the benefits of enhanced compliance and accuracy. Additionally, another 20% emphasised the importance of improved decision-making with data insights. These findings indicate a growing interest in adopting AI technologies among professionals in the payroll and HR sectors, with a clear recognition of the potential value it can bring in terms of efficiency, compliance, accuracy, and decision-making.

Impact of AI on payroll professionals and HR teams

The notion of being replaced by AI boils down to perspective. Being informed of the fact that AI requires machine learning to be fully developed and equipped with automated prompts can help to shift this mindset. Instead, leverage on AI with its automation capability to handle repetitive tasks, opening more time to focus on data-driven strategies, risk management, and employee engagement.

However, this evolution requires upskilling and therefore, fluency in data analytics and AI tools must be developed to unlock the full potential of modern payroll technologies. Research by Randstad Malaysia reveals that 34% of Malaysians have never used AI at work while Malaysia Digital Economy Corporation (MDEC) reported an estimated 70% of new job openings in 2024 will require digital skills. However, only 30% of the current workforce is adequately equipped to meet these demands, underscoring a critical digital skills gap in the labour market.

Looking ahead: Payroll trends shaped by AI

As AI continues to mature, we can expect hyper-personalised payroll experiences where employees choose pay cycles or access earned wages on demand. Real-time fraud detection and compliance monitoring will become standard, and deeper integration with national systems such as Malaysia’s LHDN e-Invoicing framework will streamline reporting. Additionally, conversational AI will allow employees to access payroll services through voice commands or chat interfaces.

Seamless integration with Access UBS Evo Payroll

Designed specifically for Malaysian SMEs, UBS Evo Payroll combines essential payroll processing features with AI-enablement, providing automation for statutory calculations and submissions while maintaining alignment with Malaysia’s ever-evolving compliance requirements. Its integration with accounting and HR modules supports seamless data flow, helping businesses maintain accuracy, reduce manual input, and generate real-time insights. This harmonised approach ensures SMEs not only keep pace with technological advancements but also scale their payroll operations with confidence and ease.

Conclusion

The future of payroll lies not in automation alone, but in intelligent automation powered by AI. As organisations adapt to the changing world of work, payroll will play a pivotal role in driving agility, compliance, and workforce engagement. Embracing AI in payroll is not just a technological upgrade — it is a strategic investment in the future of work.

To learn how Access UBS Evo Payroll can provide a holistic enhancement to your payroll and leave management system, book a demo with us >> or register for our payroll Virtual Instroctor-Led Training (VILT) >>

UK

UK

AU & NZ

AU & NZ

SG

SG

US

US

IE

IE