Benefits of a modern payroll software

Our payroll management software is trusted by over 4,000 companies across Asia to deliver payroll tasks and processes.

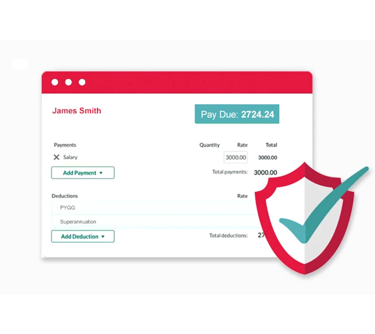

A secured online payroll platform

Transition to an online cloud-integrated payroll solution that offers multi-layer security protection.

Manage your payroll online, with the flexibility to access it anytime and from anywhere, all while ensuring peace of mind.

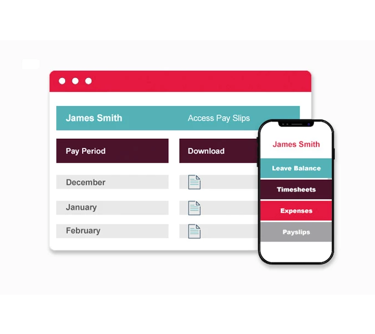

Empower your digital workforce

Remove administrative overheads by providing your employees with a cloud-based self-service portal. Make your talent happy with online payslips accessible on any device including their mobiles. Your Payroll and HR team will field less queries and employee engagement will surge.

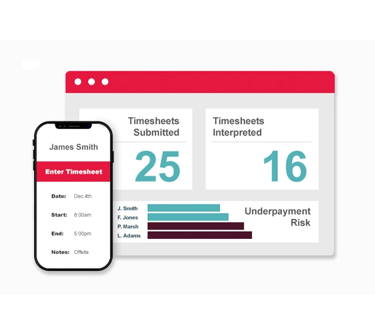

Accurate timesheets

Stop doing manual timesheet and allowance calculations

Deliver accurate payslips every time and safeguard your business from underpayments by ensuring accurate timesheets capture.

Power insights that drive better decisions

Align organisational goals with business outcomes via powerful analytics that monitor your payroll and provide key stakeholders with the insights they require to make better business decisions. From standard distributed reporting, to predictive analysis, access the information you require when you need it most.

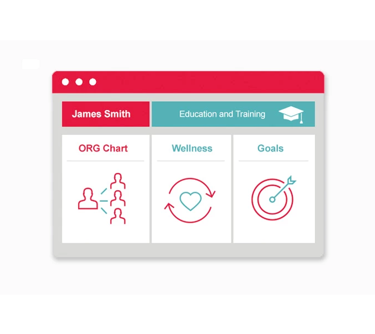

Evolve from payroll to HRMS

Get better visibility across your workforce, from hire to retire, by evolving your payroll solution into a powerful suite of HRMS solutions.

Expense management for your employees

Empower your employees to file their expense claims via their mobile device and route them for approval.

Manage your leave with ease anytime, anywhere

Empower your employees to apply for leave quickly and easily with notifications keeping you updated at every stage.

Award-winning payroll

Winner of Best Payroll Software at HR Vendors of the Year Awards Singapore

Best Payroll Software (Silver) 2023

Best Payroll Software (Silver) 2021

Best Payroll Software (Bronze) 2020

Best Payroll Software (Bronze) 2019

Powering success at any business size

The Access Group has a diverse range of payroll solutions designed to streamline your processes, engage your workforce and deliver greater visibility to your teams.

EasyPay

Best suited for up to 500 employees.

Award-winning leading payroll software solution that helps businesses across the country perform more efficiently.

UBS Payroll

Best suited for up to 100 employees.

Simplify your payroll processing and stay compliant. Integrate with other modules in the UBS product suite.

Payroll Articles

Read our payroll articles for the latest in research, best practices and insights to keep up with the best in the industry.

Read morePayroll Software FAQ

What does payroll software do? / About Payroll Software

Payroll software is an on-premises or cloud-based solution that helps you manage, maintain, and automate employee payments. Integrated, and well-configured payroll software helps businesses of all sizes comply with tax and other financial regulations and reduce costs.

Why do you need payroll software?

Payroll software provides multiple advantages to an organisation vs manual processing. It helps work out payroll calculations and deductions quicker, generate accurate payslips, calculate bonuses, expenses, holiday pay, and so much more with minimum effort.

Additionally, when the payroll software is up to date and compliant with the government, it helps to ensure that the filing of employment taxes is in order. Overall, it helps save a lot of cost and time VS manual processes.

What does payroll software do for your business?

Payroll software helps to cut down any manual execution time that HR professionals need to do, allowing them to focus on the more strategic side of the business. It also allows businesses to focus on analysing the data provided by the software to make better decisions for both short- and long-term goals.

Good payroll software can help you as a business from the early stages of your organisation to the later stages as you scale your business. A scalable software like that provided by The Access group, would ensure you do not need to spend or change your software multiple times as your business grows.

Contact us to learn more about our payroll software.

What Are the Benefits of Payroll Software for Malaysian Businesses?

Payroll software offers numerous benefits for businesses in Malaysia:

- Compliance: Ensures compliance with Malaysian labor laws and tax regulations, reducing legal risks.

- Efficiency: Streamlines payroll processing, saving time and reducing administrative burdens.

- Accuracy: Minimizes payroll errors and discrepancies, leading to precise salary calculations.

- Tax Management: Helps manage complex tax calculations and filings according to Malaysian tax laws.

- Direct Deposit: Facilitates secure and convenient salary payments through direct deposit.

- Employee Self-Service: Allows employees to access pay information and tax forms easily.

- Customized Reporting: Generates payroll reports tailored to Malaysian business needs.

- Data Security: Ensures the security and confidentiality of payroll data, critical for compliance with data protection laws.

How Does Payroll Software Ensure Compliance with Malaysian Labor Laws?

Payroll software typically includes features that help ensure compliance with Malaysian labor laws, such as:

- Tax Calculation: Accurately calculates employee income tax, EPF, and SOCSO contributions according to Malaysian tax rates and rules.

- Statutory Deductions: Automatically deducts mandatory contributions and deductions as required by Malaysian law.

- Reporting: Generates statutory reports and forms necessary for compliance with local labor regulations.

- Updates: Keeps the software up-to-date with changes in Malaysian labor laws and tax codes to maintain compliance.

Is Payroll Software Suitable for Small and Large Malaysian Businesses?

Yes, payroll software is suitable for businesses of all sizes in Malaysia, including small and large enterprises. It offers scalability, allowing organizations to start with the features they need and expand as they grow. This flexibility makes it accessible and cost-effective for businesses of various scales.