Budgeting

Budgeting

What are the best practices for school budget planning?

The school budget planning process helps to ensure the school academy or MAT doesn’t spend more money than it has coming in. This may sound quite simple but the positive impact behind a comprehensive, robust budgeting process can be financial, reputational and educationally beneficial. Schools and trusts that have control over their budgeting process can focus on wider school objectives around teaching, attainment and student wellbeing. A well-managed budget process gives peace of mind to all stakeholders – pupils, parents, teachers, leadership, governors, the local authority, Ofsted and the DfE.

8 minutes

8 minutes

Written by Jane Gibson - School Financial Management Expert

Goals of effective budget management in schools, academies and MATs

Without a well-planned budget, a school, academy or trust will struggle to make any long-term financial decisions. They won’t be able to allocate resources based on organisational needs and objectives and run the risk of descending into deficit.

A structured budget with key challenges identified in advance reduces the risk of an unexpected financial crisis. It can also save a lot of the time and stress associated with surprise financial shortfalls. Good budgeting also leads to better educational outcomes. It gives schools more scope to respond to curriculum changes and allocate resources where they are needed most.

Here are some goals you want to aim for with effective budget management in schools:

Concentrate on the bottom line

The bottom line is the biggest cliché when it comes to budget planning, but there’s a good reason for that. The fundamental principles of accountancy haven’t changed in 7,000 years. And the most basic rule is to ensure that money coming in is greater than or equal to the money going out, at least in the long term.

A focused strategy

Even more fundamental than the bottom line is the strategy that underpins it. Before you even start budgeting you should know what you want to achieve and set specific goals on the road to getting there. Your School Development Plan (SDP) should support your budget and vice versa. Effective strategy requires critical self-evaluation, a degree of patience and a good measure of vision.

Use the right tools

While the principles of accountancy and budgeting haven’t changed for thousands of years, the tools most certainly have.

Excel spreadsheets replaced calculators, which replaced abacuses. And now, cloud-based financial software packages give organisations the ability to calculate and analyse complex data without the need to manually input funding formulae. Many of these programmes can be accessed anywhere and at any time, provided you have an internet connection.

Aim for accuracy

One of the easiest ways to get into trouble with your budgeting is if your expenditure and income is recorded inaccurately.

If accuracy is consistently lacking then you can find yourself sinking into a hole that is difficult to get out of. It’s important that you make sure everything is recorded correctly and that you properly investigate any areas where you believe the books don’t reflect reality.

Have a five-year plan

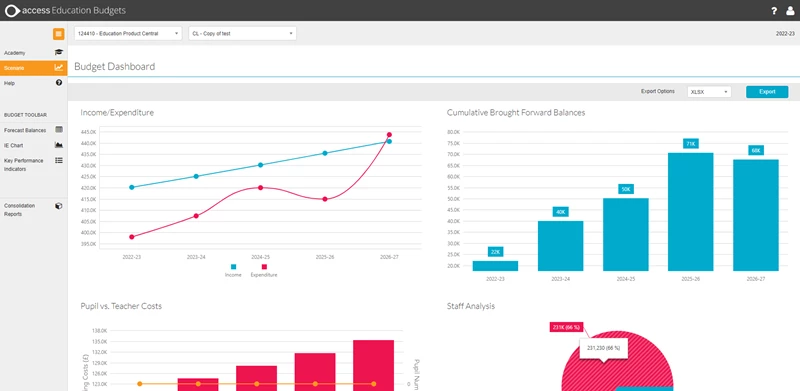

As well as an annual budget you should also prepare a draft budget for three to five years in the future. Access Education Budgeting allows users to model financial outcomes by tweaking certain key inputs like pupil numbers, staffing levels and key costs. In this way, senior leaders can view the long-term financial impact of decisions made today.

Gather context

A budget will always need context. How many staff/pupils will you have next year? How is the national schools’ budget likely to change? One piece of context that will always be important is previous year’s budgets.

Access’ Education budgeting software contains a Budget vs Actuals feature that enables users to compare their previous year outturn against the current year budget. This tool can also be used to monitor budgets throughout the year by providing reports on the budget to date and actuals to date.

Pay attention to policy debates

Schools and academies need to formulate long-term budget plans that fit in with national requirements. This can be difficult if the national requirements shift without warning. Senior leaders need to be aware of the latest spending reviews and have a sense of Department for Education (DfE) announcements before they happen. This will help minimise the risk of nasty budget-shattering surprises.

Any budgeting software should regularly be updated with all the latest DfE, ESFA and national requirements to help managers stay abreast of the most recent changes.

Ask ‘what if?’

Being prepared for external or internal surprises also requires you to model the impact of different scenarios.

High grade budgeting software enables users to plan for unlimited financial scenarios for periods of up to five years. Headteachers, SBMs and finance directors should all have the ability to review the impact of financial changes and the power to ask ‘what if?’ For example, what would be the impact if teachers’ pay increased by 5%.

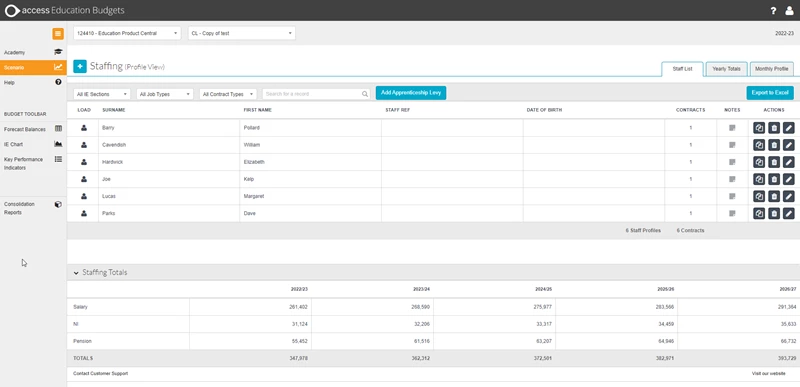

Include allowances for staffing

Staffing is one of the biggest expenditure areas in any school, accounting for anywhere between 70% and 85% of expenditure. You need to make sure that your budget includes allowances for:

- Additional costs year-on-year (superannuation and NI)

- Pay awards and promotions

- Starters/leavers and change of contracts

- Inflation

- Overtime and training costs

- Maternity, paternity and sickness pay

Access Education Budgeting software includes a Pay Adjustments Calculator that can accurately calculate staffing costs according to employee entitlements.

The calculator also gives users the ability to add a range of pay adjustment types, such as lump sums, percentage of salary and weekly Statutory Maternity Pay. This is dealt with by suspending the contracted costs for a member of staff for a specified date range and replacing it with the specified pay adjustment type.

Negotiate for the necessities

Headteachers and SBMs can often be reluctant to negotiate for the necessities because the organisation can’t run without them. Good negotiation doesn’t have to be brash. Effective negotiators are organised and visit multiple suppliers before suggesting a price point. Remember, the worst they can say is no.

Push for luxuries

If you can drive a hard bargain for essentials, think what you can do with luxuries. It’s also important that you know the difference between a luxury and a necessity. Try writing an objective purchasing policy or developing a test to prevent subjective opinions blocking your lean budget.

Increasing student numbers (if you have gaps)

If your cost per pupil is fixed but you have spare capacity then you might want to think about prioritising your pupil numbers. To attract more students, think about marketing your school, academy or trust to undecided parents and students. A solid social media presence and a relationship with local newspapers are good places to start if you want to project a positive external image.

Alternative revenue

If you are at capacity and struggling to balance the numbers then you may need to explore alternative funding streams. Modelling investment decisions like ‘whether or not to invest in a new all-weather sports pitch’ to help generate extra revenue is worthwhile. You can also seek to raise money through lettings and fundraising events.

Creative cost cutting

If you are still struggling to raise money, then it is time to think about where you can cut costs. But think carefully about laying off staff because this can sometimes end up costing more in making up numbers with agency staff and could affect the quality of your provision.

Some of the more creative money saving measures we have seen are things like growing a vegetable patch to stock the canteen and claiming government incentives for generating renewable energy. Getting children involved in these decisions can also equip them with valuable life skills.

Ensure information is accessible

The ability to access information easily is crucial to ongoing budget monitoring. Ensure your choice of budgeting software comes with an easy-to-use reporting suite capable of producing comprehensive reports in a number of formats. Tables, charts and graphs can be produced in varying amounts of detail so they can be tailored to the needs of any stakeholder. Reports can also be exported into Excel and PDF file formats – making them easy to email and share.

Cloud-based software means that you can access it anywhere and on any device with an internet connection.

Improve visibility for stakeholders

Printing off and distributing financial information to governors, bursars and administrators is a bad use of valuable time, but it’s important to keep stakeholders updated on progress. Budgeting software should allow you to assign different access rights to different users, meaning that some can be granted ‘read-only’ permission without the need to worry about someone accidentally or maliciously altering data. This feature is particularly useful for local authorities and multi-academy trusts where multiple institutions and several layers of administration make it essential to have varying levels of access. You want to be able to control permissions at a trust level and push out any changes to all or some schools as and when you need to.

Involve governors

Governors have a number of important responsibilities when it comes to school budgeting. These include managing and approving budget plans, considering revisions and deciding on certain spending priorities. In addition to these important budgetary responsibilities, governors often have a number of specialist skills and experiences that can be very valuable to schools, academies and MATs. Skills that are often in demand include:

- Accountancy

- Legal

- IT

- Planning

- Procurement

- PR and marketing

- Community engagement

- Experience working with children

- Experience working with children with special educational requirements

Schools should seek to make use of any specialist skills on offer and work hard to foster good relationships between senior leaders and the governing body

Engage with the wider public

As well as drawing on the skills of governors, schools, academies and MATs should also seek to engage constructively with the wider public. Parents, neighbours and community leaders all have a role to play, either by contributing resources or by helping out with activities. Local businesses are also often willing to contribute through donations or sponsorship.

The 4 critical stages of the academy, MAT and school budget planning process

While there are several steps to the academy, MAT and school budget planning process, they fall broadly into four stages: review, planning, forecasting and implementation/evaluation. Each stage of the process feeds into the next and it follows a cyclical process, relying on predetermined actions at specific points of the year. The benefit is a considered, informed and realistic budget that sets schools, academies and trusts up for financial success.

MAT, academy and school budget review

Reviewing past performance against budgets can be revealing. How accurate was the budget? Where did the underspends and overspends occur? These questions can help you shape your academy, MAT or school budget and increase its accuracy. Look at the cost base too. It can give you a foundation on which to build your budget and be a prompt to review expenditure. Benchmarking against similar schools can help you understand how your spending compares and put it into context. It’s also an opportunity to identify cost savings or improvements.

MAT, academy and school budget planning

Once you’ve gathered your historical data and carried out the benchmarking, it’s time to think about your resource, staffing and accommodation needs for the next year. The planning stage shouldn’t be a one-step process. It’s important to model a range of income and cost scenarios based on your most important data. To be as accurate as possible in your planning, consider data such as:

- Changes in funding (revenue and capital income)

- Number of pupils and their characteristics

- Class and group sizes

- Staffing profiles and increments

- Pay and price increases

- Procurement and maintenance

- Longer-term development plans in areas such as asset management, premises, staff and IT/ICT

- Local Authority Plans/Central Government Plans

- Ofsted reports

Our MAT, academy and school budget planning guide can provide more help on planning your budget effectively.

MAT, academy and school budget forecasting

Your three to five-year forecast should be more than your ‘best guess’ for it to be useful. Yet it’s difficult to predict changes in areas such as funding, pupil numbers and staffing costs. It can be beneficial to get involved in the local community to stay abreast of developments which could impact your school. Being active within the wider education sector can also give you insight into factors most likely to affect you. You can use this knowledge and your historical data to model a range of income/cost scenarios to assess the impact of varying factors on the budget. Factors to consider include:

- Funding over the next three years

- Changes in pupils and their characteristics

- Curriculum changes

- Likely staff profiles

- Teaching staff salary rises

- Inflation

- Aims of the school development plan

- Longer-term improvement and development aspirations

‘What if’ analysis is most useful when you model trends rather than one-off changes and apply the highest probability and impact. This process is made much easier, quicker and more accurate by using MAT, academy and school budgeting software.

MAT, academy and School budget implementation and evaluation

Once the budget gets approval from the governing body the budget is implemented, and monitoring and evaluation should begin. Setting out budgeting best practice as well as conducting a monthly review will highlight areas of potential risk early enough to act. It also makes life easier when it comes to submitting budget monitoring returns to the DfE.

While evaluation is the final stage of the school budgeting process, it feeds back into the first stage. Ongoing evaluation gives you a head start on the following year’s review and helps you to reforecast if and when you need to. By keeping a close eye on the budget throughout the year, you can identify ways in which resources and budgets could be used more efficiently or differently. For example, where there is recurrent underspend meaning money could be shifted to other resources in the future.

Get clear and sustainable budget planning with our school budgeting software

Using a school budget planning calendar

The financial year is typically different for maintained schools and academies, with the former running from April to March and the later September to August. As such there is different guidance as to when school budget planning takes place within the different types of educational institution.

Budget planning calendar for maintained schools

The most recent guidance on financing local authority maintained schools says a three year budget must be submitted to the local authority at a date agreed between the school and the LA. This happens sometime between 1st May and 31st June. Forecasts such as these are used by the local authority to make sure schools are managing their budget effectively.

Things to be considered in the budget for maintained schools are:

- Estimated pupil numbers

- Free school meal entitlements

- Approximate pupil premium income

- Planned staffing increases

If local authorities end up with a surplus of cash (7.5% for secondary schools and 12% for primary schools), local authorities can enforce a balance control mechanism which means they will clawback the surplus money if they cannot determine the intended purpose of the extra money. This is decided on by a panel of people who consider the following criteria for surplus budgets and whether it can be justified or needs to be returned:

- Contribution to capital projects

- Funds held on behalf of other schools

- Late allocations

- Other grant income and funding sources

It’s equally important for maintained schools to be spending their funding as it is to make savings, to ensure they maintain an appropriate level of income over the course of several years. Consult with the government issued local authorities budget planning calendar for more granular dates and detail about things like ESFA funding, school census information and pupil premium.

Budget planning calendar for academies

GAG or the General Annual Grant is the main source of funding for trusts and academies – GAG funding is paid directly to the school’s bank account every month. Pupil premium is another tranche of funding which is paid in quarterly instalments in July, October, January and April and aims to help improve the academic outcomes for disadvantaged students.

It is important to ensure these payments are factored into your budget planning calendar and that you are up-to-date with the latest guidance in case legislation changes. The government publishes a budget planning calendar for academies which can help trusts plan their activity throughout the year, the latest calendar can be found on the gov.uk website here.

On the whole, the considerations for budgets in trusts and academies are much the same as they are within maintained schools, but there is no risk of the local authority looking to clawback any surplus funds. It is at the direction of the board to consider how best to reinvest these funds in the trust throughout the academic year.

There are some additional pots of funding that MAT s and academies are able to access that local authority maintained schools aren’t eligible for. For example, TCaF or Trust Capacity Fund. This money aims to help trusts absorb underperforming schools to improve them. More information about TCaF Funding is available on the government website here.

How MAT, academy and school budget planning software can help

MAT, academy and school budget planning software can really help educational institutions budget effectively. It allows them to streamline and automate their budgeting process, improve financial management, and ensure long-term sustainability. Here are some ways in which school budget planning software can help:

Plan and monitor your budget

With the help of MAT, academy and school budget planning software, organisations can create a comprehensive and realistic budget plan that takes into account all revenue sources and expenses. They can monitor their actual spending against the budget plan and adjust their financial strategies accordingly to ensure they remain on track.

Create forecasts for up to five years

School budget planning software can generate financial forecasts for up to five years, giving schools the ability to plan for the long term. Often the software makes assumptions and automatically recalculates for you. For example, pupil numbers in year 1 will feed through to year 2 and so on. This allows schools, academies and MATs to identify any potential financial risks and opportunities and make informed decisions about how to allocate their resources.

Model the impact of change

MAT, academy and school budget planning software can model the potential impact of various changes on the budget plan, such as changes in enrolment, staffing levels, or funding. This helps schools to evaluate the potential financial impact of any proposed changes before implementing them, enabling them to make more informed decisions.

Quickly produce comprehensive reports

MAT, academy and school budget planning software can generate comprehensive reports quickly and easily, providing real-time financial insights. This allows the organisations to make timely decisions and adjust their financial strategies as needed.

Next steps

It’s essential that your school budget planning is done effectively and with appropriate tools that can help your trust or school financially thrive. As well as our school budgeting software and MAT budgeting software we have comprehensive school finance software and MAT finance software which integrates seamlessly with the Access Education suite as well as third-party tools too.