Travel, motor and mileage expense software

With travel expense software, employees can claim corporate travel expenses when they’re out and about – whether from the train, in the airport lounge or on the road.

Easily record and reimburse travel expenses

Employees can track mileage and scan their receipts easily. No more manual entry needed. Approvers can sign off claims with confidence thanks to accurate Google Maps calculation and automatic policy enforcement. Staying compliant with HMRC requirements is made easy with inbuilt tax tools for company cars and business travel expenses.

Watch how our travel and expense management software works

"The whole process is now electronic, end-to-end. Our employees can submit new claims in seconds. They simply use their mobile phones to take pictures of all their receipts, often just as they have received them, upload them into the Expense app and submit. It means fewer receipts are lost or forgotten and they don’t have to wait until they are next in the office, which for some could be weeks or even months, before wading through a whole batch of claims." — Karen Mayne, Purchase Ledger and Purchasing Team Leader at Bytes

Quickly log accurate mileage with travel expense software

Employees can input their journey, and the distance is calculated for them, so it’s 100% accurate and saves time.

- Set a default home address and choose a destination by postcode, street address, offices, landmarks and more, choose one-way or return journey

- Mileage is automatically calculated using Google Maps and allows manual mileage logging in case of diversions

- Inbuilt verification tool - postcode finder, uses technology to increase accuracy

- Inaccurate claims are instantly disallowed

Reimburse business mileage at the right rate

Approvers and finance teams can rely on inbuilt verification and rate features to calculate the amount due using the correct rate.

- HMRC-approved rates are inbuilt or set custom mileage rates

- Users are automatically dropped into the lower bracket when they go over the threshold

- Expenses can be claimed on-the-go via the app, or by using the browser version

Manage company vehicles and private usage

Stay on track with reporting, tax treatments and payment liability related to company cars. Easily fulfil your duty of care and ensure anyone using their car for work purposes is safe and compliant, by storing necessary documents and receiving automated alerts when they need renewing.

- Mileage and fuel claims on company cars can be tracked for reporting and tax purposes

- Store documents such as vehicle tax, insurance, MOT and licence details of privately-owned vehicles used for work

- Licences due to expire are automatically flagged

- Get private recovery of VAT around projects

- Monitor vehicles through different stages of approval, i.e. approval from the manager and the finance team

- Claim validation

Other expense software features

Cloud-based expense management and automation

Submit, approve and administer every type of business expense claim online so they are processed quicker.

Credit card expenses

Credit card statements can be uploaded into the software and expenses allocated to multiple cardholders' accounts to reduce admin time and input errors.

Monitoring and reporting

Live dashboards - which can be configured to your needs - provide real-time view of expense costs to monitor spending.

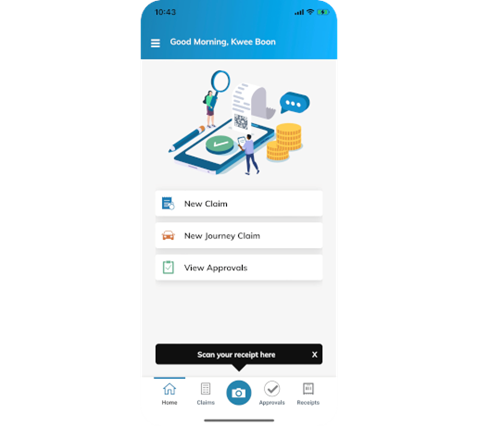

Expense app

An easy-to-use app means expenses can be submitted by employees, then quickly reviewed and approved by line managers all from a mobile and tablet.

Fully supported

You can confidently switch to Access and get up and running quickly. We've successfully implemented our software for thousands of customers, so we know what it takes to make a smooth transition.

Frequently Asked Questions

What are the key features of Access Expense?

Access Expense allows your employees to automate claim processing, track spending, and easily create reports. Additionally our expense management software comes with features and benefits such as:

- In-built claim verification and approval tools

- Supporting HMRC-approved and custom mileage rates

- Secure storage of relevant vehicle documents

- Sending out notifications when documents are due to expire

Learn more about expense management software features.

How can I track travel motor mileage with Access Expense?

The app's integration with Google Maps for journey input and recent addresses can streamline the process of submitting travel expenses, automating the input of journey details and descriptions.

Is Access Expense software the right solution for me?

The solution's single sign-on features and integration with other Access Workspace products like Access Financials and third-party apps enable you to securely add, view, and approve travel expense claims on the go. Our industry-leading cloud technology allows you to share necessary information across departments, providing real-time visibility of your financial information. The Access Expense mobile app enables you to take pictures of receipts, enhancing convenience and efficiency in expense claim submission and approval. Book a demo to see how your business can benefit from using Access Expense.

Does the Access Expense software support the claiming of mileage allowance VAT?

Yes, Access Expense supports claiming back VAT on mileage allowance. If your employees buy fuel during business travel and you need to claim mileage allowance VAT, our article provides detailed information on claiming mileage allowances VAT.